Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

February 2024 - Week 1 EditionGold Nears an All-Time High, Then Falls on Fed News and Jobs ReportThey never seem to learn. It’s like the movie, “Groundhog Day.” Gold traders and stock traders react to words or actions from the Federal Reserve, or the monthly jobs report, to trade gold or stocks up or down, based on premature information or faulty theories. It’s like that fuzzy old myth that the appearance of a groundhog on February 2nd has anything to do with the early or late arrival of spring. But it’s even more like the Bill Murray movie, “Groundhog Day,” in which he repeats the same routine, every day, forever, only this time, the trading nonsense actually happened on the real Groundhog Day, Friday, February 2. Let’s rehearse gold’s two-fold reaction to the Fed and the jobs report last week: First, gold’s reaction to the Fed’s announced delay in interest rate cuts (from the presumed date of March 20 to a more likely May 1) was short and muted compared to the market’s overreaction to the Friday jobs report. Fed Chair Jerome Powell’s press conference on Wednesday, January 31 was greeted with a quick 285-point drop in the Dow Jones index but a rather modest gold correction. Gold moved from a near-all-time high of $2,065 in the morning futures market to $2,030 before rallying to close at $2,048. On Thursday, gold again rallied to $2,064, only to fall precipitously to $2,031 on Friday’s huge “fake news” monthly gain of 353,000 jobs in January. Both reactions are silly but the reaction to the jobs report is even sillier than the chronic overreaction to the Fed’s press conference. The Friday jobs report is premature, political, inaccurate and irrelevant to the gold market. It is premature because there is no way the Bureau of Labor Statistics can accurately survey all companies and households within one day of the end of January to tell us how many jobs were truly created. That’s why the BLS revises each previous month’s job totals by massive amounts in the following months. The inaccurate and politically motivated jobs total, especially in January, is subject to “seasonal adjustments” to make it appear more favorable to the incumbent party, especially in an election year. Three other labor force data sources contradict the BLS payroll figure. First, Wednesday’s ADP Employment Report, run by the people who provide private payrolls, shows private payroll growth slowed to 107,000 jobs in January, far short of the expected 150,000. ADP stated that hiring was slow in all sectors: “Private payroll growth declined sharply in January, a possible sign that the U.S. labor market is heading for a slowdown this year.” Second, the BLS’s own household survey showed the number of employed workers fell by 31,000 in January, following a drop of 683,000 in December. Finally, the Challenger Job Cuts Report showed layoffs of 82,307 in January, a 136% rise over December, as many tech companies are laying off people. At best, someone is mistaken. At worst, someone is manipulating the truth: Gold is falling for no reason at all – as usually happens with mindless trading. Biden’s Energy and Border Policies May Guarantee His Loss in NovemberSome said George Bush, Sr. was tired of politics in Washington DC in 1992 and didn’t want to win re-election, so Mr. “Read My Lips, No New Taxes” actually raised taxes. His favorable ratings went from super-high, after winning Gulf War I in 1991, to super-low in 1992. Now, 32 years later, it’s as if another tired old politician from the other party doesn’t really want to win re-election. That’s because he is doing everything possible to alienate voters – with high energy prices, open borders, and job-killing programs. The Biden Administration recently halted approval of new licenses to export liquified natural gas (LNG). Specifically, the Energy Department is now supposed to scrutinize how LNG shipments affect climate change, the economy and national security. In doing so, President Biden said, “We will take a hard look at the impacts of LNG exports on energy costs, America’s energy security and our environment. This pause on new LNG approvals sees the climate crisis for what it is: the existential threat of our time.” He is so wrong. Even environmentalists admit LNG is a clean alternative to coal. Green advocates contend that switching to LNG is crucial for getting developing nations to stop using coal and enabling Europe to power its economy without relying on Russian natural gas. However, environmentalists on the Biden team warn that building the enormous infrastructure required to ship LNG ensures that natural gas will be wasted, resulting in more coal burning, which is booming globally, since coal is cheap and popular in China, Eastern Europe, India, Indonesia and other emerging economies. America has a glut of natural gas since much of it is a byproduct of crude oil. We are hurting our allies and ourselves by wasting it. Biden is likely to lose Louisiana and Texas anyway, but there are LNG sources in Ohio and Pennsylvania, which are swing states, so he may have already lost the election by shutting out good energy jobs in those states, which is a good thing because a new president can undo his inane actions. Happy Birthday Ronald Reagan!February 19 is President’s Day, but they ought to call February President’s Month, honoring Lincoln, Washington and another great president, Ronald Reagan, who was born on February 6, 1911. In fact, we might say these three men were the three greatest U.S. presidents of the 18th, 19th and 20th centuries. Reagan’s official biographer, Edmund Morris, began his book, Dutch, with some of Reagan’s acting flair: “At 4:16 am on February 6, 1911, Ronald Wilson Reagan was born feet first, after 24 hours labor. Even in the womb, it seems, he plotted his entrance with dramatic effect. He weighed 10 pounds.” – Dutch, p. 14. Reagan was born in Tampico, Illinois, the second and final son of Jack and Nelle Reagan. Almost 70 years later, on the day before Reagan’s 1980 election victory, it was a rainy Monday, but as the rain lifted, a rare double rainbow appeared over the site where Reagan was born. Lloyd McElhiney, manager of the local grain elevator, ran home hoping the image would last, grabbed his camera and caught the image. In our business, we honor Ronald Reagan as a champion of the gold standard, the last President with memories of holding legal tender $20 gold pieces in his hands as an adult – they were taken out of circulation when he was 22, in 1933. He is also the President who returned gold coinage to legal tender status during the 1980s, first with the $10 1984 Los Angeles Olympic commemorative coin, and then the 1986 American Eagle series of coins: 1 ounce ($50), ½-ounce ($25), 1/4-ounce ($10) and 1/10-ounce ($5).

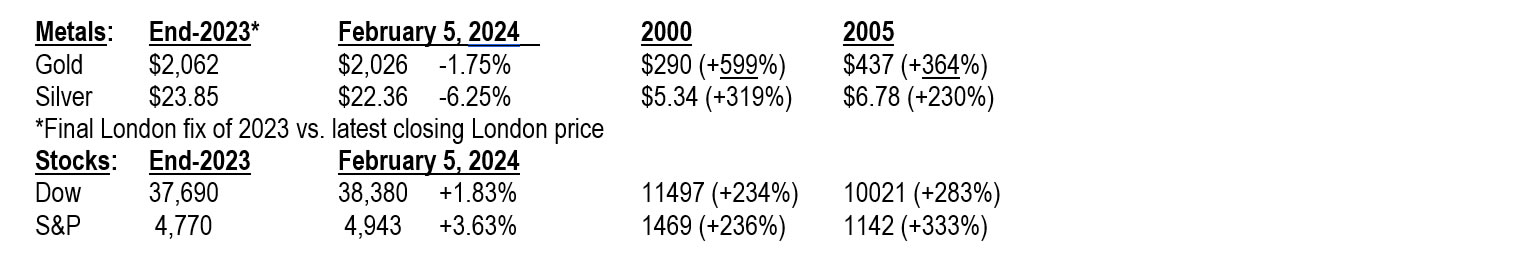

Federal Reserve’s News Shouldn’t Hinder Gold’s PerformanceGold rallied most days in the last week, only to correct after some politically-proclaimed “good news” on the economy was released. However, that news was based on a twisted (and false) theory that “good news is bad news” since it just postpones the day when the Federal Reserve will start to lower interest rates. However, we believe history shows that gold typically rises during times of high-interest rates and especially during times of prosperity, when more people can afford to buy gold. Gold also rises during times of crises and overseas wars, especially in sensitive energy-producing regions, like Russia, the Middle East, and potentially Venezuela this year. Historically, gold has also risen in the final year of the past four contentious election cycles of the Obama/Biden/Trump era.

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |