Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

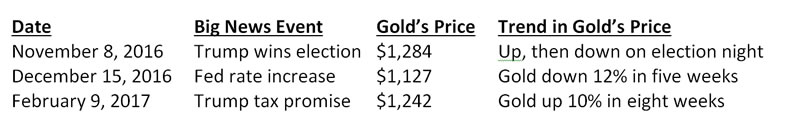

February 2017 – Week 2 EditionGold and Silver Are Still Outperforming Stocks So Far in 2017Gold and silver are still outperforming stocks so far in 2017, and over the last 15 years. Late last year, gold fell after the election, but it has risen since Donald Trump took office, partly in response to his series of controversial statements and Executive Orders. It is safe to say that the nation and the world has never seen a President act so quickly to fulfill his many campaign promises. At first, the U.S. dollar fell in January, boosting gold in dollar terms, but the dollar rose over 1% last week, making the continued rise in gold (in U.S. dollar terms) all the more impressive. Silver is up even more – up nearly 11% so far in 2017. Major European Banks Grow More Positive on GoldThe Euro-zone is in for more “Brexit” threats and Trump-like elections this year. Nationalist candidates are leading the polls in the Netherlands and France, which stage elections over the next two months. The Greek financial crisis is also resurfacing, so there is a threat of a “Grexit” (Greek exit from the EU) and even a “Frexit” (French exit, due to the favored candidate in the polls seeking separation from the EU). If a major Euro-zone nation like France exited the EU, the EU and the euro would begin to unravel. This uncertainty – in addition to the Trump Tornado in Washington – is driving European investors to gold. UK’s banking giant HSBC (originally the Hong Kong and Shanghai Bank Corp) sees the gold rally of early 2017 continuing due to political uncertainties in the U.S. and Europe. James Steel, precious metals market analyst for HSBC says that “the pessimistic assessment of the Greek economy and reform by the IMF (International Monetary Fund) has triggered ‘muscle memory’ in the gold market, as Greece was the epicenter of sovereign-risk crisis during the last financial and economic crisis.” Although HSBC expects a near-term correction, “the rally appears intact…and we expect gold to resume the upside after a pause.” Ole Hansen, chief commodities strategist at Denmark’s Saxo Bank, also sees a short-term correction due to a technical formation called a “triple-top” at around $1,235 per ounce, causing some short-term price resistance, but he adds: “We still think that the market is targeting $1,250 per ounce on the upside so long as we stay above $1,220.” He sees the upcoming French election in April and other scheduled European elections this year driving investors into gold for safety, especially vs. the weakening euro currency. The French bank Natixis also cited chart patterns showing gold’s strength. They cited two indicators: (1) an “upside channel” in force since the middle of December – a bullish technical chart formation, and (2) a technical measure they called “Fibonacci retracement markers,” referring to a mathematical formula for the limits of price corrections. Analysts at Natixis concluded that dips in the gold price “should be seen as corrective and we favor an extension of the rally in the next days to $1,250 to $1,254” per ounce. Trump is Good for Gold After AllRemember election night, when gold soared at first, only to fall the next morning and then keep falling until mid-December, right after the Federal Reserve raised interest rates 0.25% points? At that time, the legendary billionaire investor Stanley Druckenmiller boldly claimed, “I sold all my gold on the night of the election,”explaining that “all the reasons I owned it for the last couple of years seem to be ending.” At the time, Druckenmiller went on to explain that he was optimistic that a Trump administration would bring deregulation and “serious” tax reform. Last week, that promise came closer to fruition, when Trump said he had a “phenomenal” new plan for tax reform, to be released in the next 2-3 weeks. Both gold and stocks rose on the news. Last Tuesday, however, Druckenmiller made it public that he had bought gold back in December and January because the currency market was not an attractive option. “I wanted to own some currency and no country wants its currency to strengthen,” he said last Tuesday in an interview. In December, he explained, “Gold was down a lot, so I bought it.” That was excellent timing, since gold bottomed out at $1,129 on December 15, but the news of his purchase only surfaced last week, when gold was $1,235, so investors who followed Druckenmiller’s words missed the recovery.

Bottom line, long-term gold investors should hold through corrections, or buy more, not sell into a panic.

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |