January 2015, Week 2 Edition

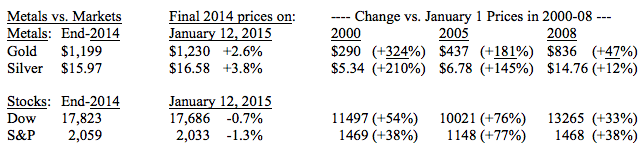

Gold opened 2015 on a strong note, gaining over $30 per ounce to $1,230 as of noon Monday, January 12. Gold is up 2.6% and silver is up 3.8% vs. declines in the major stock market averages so far in 2015. The proximate cause is the new threat of the Greek exit (or “Grexit”) from the euro-zone, along with the threat of deflation in the euro-zone, the rise of the dollar, the fall of the ruble and other “normal” world events which have suddenly found their way back to the front burner in the world’s financial media.

CNN/Money Makes a Simple Math Error … and it’s Copied Worldwide

Speaking of gold’s rise in the new year, one of the leading financial news sources in the world committed an obvious math blunder on the price of gold last week….and nobody seemed to notice (except us?)

Last Wednesday, January 7, 2015, CNN/Money published a review of gold’s first week in 2015 vs. other investments. The headline was: “Gold bugs rejoice for now at least.” It contained this obvious math error:

“Gold often does well in times of political turmoil. Prices spiked to a record (not adjusted for inflation) of above $1,900 an ounce the last time there were serious concerns about Greece and Europe back in 2011. But gold has been a dog of an investment since then. Even after its recent spike, it is still trading for only around $1,210 an ounce ... nearly 60% below its all-time peak.”

No, that’s a 36% drop. If you divide gold’s $690 decline (1900 minus 1210) by 1900 you get .363, or a 36.3% decline. A 60% decline from gold’s record high of $1900 would get gold down to around $760.

As obvious as this math mistake was, the CNN Money article was picked up by a few other Web sites and news agencies, printed verbatim. Hasn’t anyone out there mastered their basic 8th grade math skills yet?

The article concludes more sanely: “The allure of gold to its fans is that it is a tangible asset. The value is determined, for the most part, by supply and demand. And supply is fixed; it’s basically what you can find in the ground and is available on the open market. The supply of dollars, euros, yen and other paper currencies can be increased or decreased by the central banks of governments. They simply turn on or shut off the printing presses. ‘Global money printing — first by the Fed, now by Japan and likely soon by Europe — is sowing the seeds of future inflation. That may be years from now, so it's not an immediate concern. But that's why we believe investors should have a small allocation to gold or other inflation-correlated assets in their portfolio,’ wrote analysts from USAA Investment in their 2015 market outlook.”

The Coin Hobby Protection Act is Finally Passed into Law!

“The Collectible Coin Protect Act” (HR 2754) passed the Senate unanimously on December 15 and became the law of the land when President Obama signed the bill three days later. After November’s overwhelming Republican landslide, the “lame duck” Senate finally began moving some legislation that had lain dormant in the Senate for months, if not years. With the Republicans taking control of the next Senate, the co-operation of the Senate Democrats and the President gives us hope that the new Congress can work more closely together to pass bi-partisan legislation in the new term, beginning this month.

We are very proud of the work of the Industrial Council on Tangible Assets (ICTA), of which I am a board member, and former Louisiana Congressman, Jimmy Hayes, now our legislative consultant, who called this law’s passage a “textbook on bi-partisan effort.” This bill was first introduced as HR 5977 in June 2012, when I was among a half dozen of the country’s leading numismatists to meet in Washington DC with Congressional leaders and staff members to promote legislation to protect the public from counterfeit coins and counterfeit authentication documents – a trend which has grown, along with counterfeit-coin-making technology. The original Hobby Protection Bill was passed in 1973, but the passage of HR 2754 strengthens the original law, giving federal law enforcement officials the necessary tools they need to better attack these dangerous practices.

Louis E. Eliasberg – The King of Gold Coins

Louis E. Eliasberg Sr. came to be known as “The King of Coins” after he accomplished a feat many thought to be impossible: Over a period of less than two decades, from 1934 to 1950, Eliasberg assembled the only complete collection of U.S. coins – the only one that contained regular-issue coins of every denomination from every date they were issued and every mint that made them in those years. News of this achievement not only electrified fellow hobbyists, but also impressed the entire nation. It was considered so significant that Life magazine, then required reading for millions of Americans, featured Eliasberg and his coins in a lavish photo layout. Yet, this “King of Coins” didn’t have kingly wealth. He lived comfortably on his income as a Baltimore banker, but his budget for buying coins was not unlimited. Nor was he known as a big spender: Dealer who did business with him found him to be a cautious buyer who took out his checkbook only after careful deliberation. Eliasberg wasn’t even a hobbyist when he started buying coins: He did so as a way to circumvent the Gold Surrender Order of 1933, which required U.S. citizens to turn in their gold coins, but exempted collectible coins. “I realized the only way I could legally acquire gold was by becoming a numismatist,” he explained years later. “So in 1934, to the extent of my means, I started buying gold coins.”

Soon bitten by the hobby bug, he started buying other coins as well, and within a few years he had built a respectable collection. Then, in 1942, came a marvelous opportunity: He was able to purchase outright the outstanding collection of John H. Clapp – in the process acquiring many rare coins he didn’t already possess. That’s when he began thinking seriously of pursuing the impossible dream: a U.S. coin collection with “one of everything.” He prepared a list of coins he lacked and started tracking them down in auctions and dealers’ inventories. “Eliasberg struck me as a gentleman,” one prominent numismatist later recalled. “He was tall, aristocratic, a genius at finance, but he didn’t know very much about coins… He knew more about making money.” His success at making money has become the stuff of legends in the coin collecting community. During the decade and a half it took him to complete his collection, Eliasberg spent less than $400,000. When the collection was sold, at a series of auctions between 1982 and 2005, it realized a grand total of roughly $55 million – more than 100 times what he had paid.

The gold coins he started buying in 1934 not only turned Eliasberg from a numismatic novice into a great collector, but also ended up confirming his status as a very successful investor. In short, even if he had never begun pursuing the seemingly impossible dream of collecting “one of everything,” Eliasberg would have made millions just through his decision to buy gold coins as collectibles.

Metals Market Report Archive >

Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher.