Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

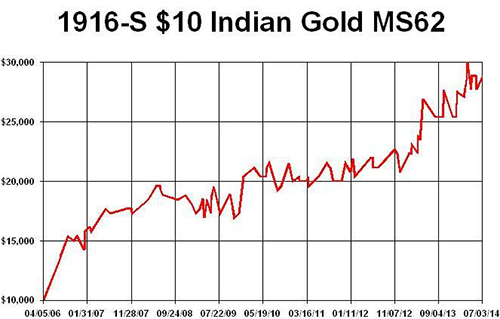

August 2014, Week 3 EditionGold continues to hover around $1300 per ounce, partly due to the temporarily strong U.S. dollar (vs. the euro). Due to the euro-zone's trade restrictions with Russia, and the threat of a Russian reprisal, some of the major European economies (like Germany) are falling into a recession again, resulting in a weak euro. In terms of the euro, gold is up about 12% this year (vs. 8% in U.S. dollar terms). In fact, gold in euro terms is now approaching the psychological barrier of 1000 euros per ounce. (If gold trades at $1300 per ounce and the euro sinks to $1.30, then the euro price of gold will reach €1000, an important benchmark.) Two Experts Make the Case for Gold on CNBCCNBC is the widely-watched stock-market-oriented financial channel. Most brokerage firms have the CNBC screen running during the market trading hours from 9:30 am to 4:00 pm (Eastern time). CNBC runs a price ticker for gold along the top of the screen, along with the major stock index prices, and they also cover gold whenever there is a move. Last week, CNBC gave major air time to several gold bulls. Robert McEwen, founder of the major mining firm Goldcorp (as well as his own firm, McEwen Mining), told CNBC that gold is "outperforming the Dow and the S&P and large segments of the market” this year. Then, he added, "We're entering a period of the year when there's a seasonal high for gold - September, October is usually a strong period for gold going into the end of the year…. There's a lot of armed conflict going on around the world.…I see it ultimately getting to $5,000 an ounce over the next 3-4 years.” Matt McLennan, head of the Global Value Team at the $100+ billion investment management firm First Eagle also appeared on CNBC, counseling gold as a portfolio crisis hedge, saying: "We live in a world where there's too much debt and not enough jobs, and that's leading to financial repression everywhere. And in a world of monetary abundance, we're looking for scarcity, be it in businesses that have hard-to-replicate assets or business models, or in gold itself as nature's alternative to the man-made financial architecture. And so we see gold as…part of a portfolio that's all-weather in nature.” Dennis Gartman Sees Global Tensions as a Springboard for GoldCommodities analyst Dennis Gartman is not "perma-bull” on gold. He merely follows (and rides) the trends. He also looks at gold in terms of several currencies, not just the dollar. In commenting on the recent price trends of gold in euro terms, he said that "Once €1,000 is taken out - and we think that it shall be, if not today, then next week if the geopolitical events unwind as badly as we fear they might - then there is nothing that stems the advance until €1,100.” (For comparison purposes, the peak gold price in euro terms was €1,350 in late 2012, over a year after gold peaked at $1,920 in U.S. dollars in 2011.) So far this year, gold is up 12% from 874 euros on December 31, 2013 to 976 euros on August 15, 2014. During most of 2014, gold has tended to rise when tensions escalated in Ukraine and the Middle East. As the world's wars continue to escalate, we can expect to see both oil and gold prices rise. As Mr. Gartman summarized the connection between gold and war: "When war is in the air, gold goes bid. What else can gold do? Capital is fleeing to the safe corners of the world, and when that happens it flees to gold.” Rare Gold Coin Performance ChartsFor decades, I have liked better-date rare gold coins. I even wrote multiple NLG award-winning books about them. Currently I believe it is a historically opportune time to acquire select better-date gold coins in better grades. This week's graphs show how a portfolio of multiple or fractions of coins totaling $10,000 in different rare gold coins would have increased in value over the time indicated that I have purchased them. These graphs reflect the price gains of actual coins I have been fortunate to buy, showing an increase from $10,000 to as much as $53,000. Some series are trending upward and others seem to be at bargain levels to many experts. Segments of this market now remind me of the old oil filter commercial that said "You can pay me now or pay me a lot more later.” I recommend at least a 5-10 year hold period on rare coin purchases as these graphs show impressive gains and volatility can occur during a shorter time span. We all know that past performance of some coins does not guarantee future performance for all coins. Many experts recommend buying better-dates and grades because of often better long-term performance for much of the past 100 years. Read my books to learn about famous successful long-term gold coin set builders like Louis Eliasberg. His set building provided him long-term benefits of diversification and significant premiums were later realized.

|