Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

July 2014, Week 4 EditionGold rallied once again, and then corrected, based mostly on the ebb and flow of global tensions in Ukraine, Israel and Iraq, but gold stayed above $1300 per ounce this time, so it's another case of "two steps up and one step back," which is gold's normal bull market behavior pattern. Early this week, gold opened at $1318 but then took another step back to $1310, but we are holding well over $1300 for now. If 2013 was the year of gold's "tug of war" between physical buyers and paper-gold sellers, 2014 is so far the year of global tensions. Gold has tended to rise and fall this year based on eruption of global tensions. TRULY RARE COINS OFTEN PERFORM WELLLouis Eliasberg (1896-1976) was a Baltimore-based businessman and famous coin collector who assembled a complete collection of U.S. regular issue coins from 1925 to 1950. In the following 25 years, he kept his collection current by adding a few pieces in better condition. After he died, his gold coins were put up for auction in 1982, followed by his silver, copper and nickel coins, sold in 1996-97. These three Eliasberg auctions are legendary in the numismatic community for their superior quality and for the phenomenal profits realized on the sale of the collection at the time. Looking at some Eliasberg gold coins sold in 1982 vs. their value now, we see that some of these gold coins continued to rise and have risen 20 times in value, vs. gold bullion's three-fold rise since then.

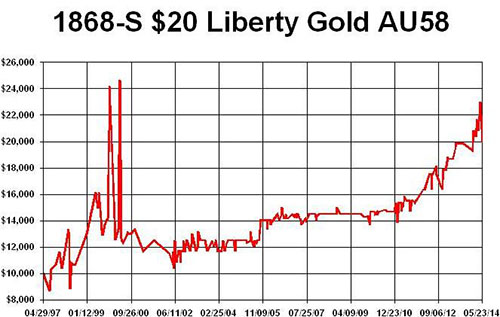

BITCOINS ARE FACING STIFF REGULATIONS, TOOThere is an interesting development in taxation and regulation of "Bitcoin" sales, too. A friend of mine at the recent Freedom Fest noticed that panels and talks about bitcoins were overflowing, while gold talks were only lightly attended. That is a good sign that gold is undervalued and bitcoins may be a fad. The sales pitch for bitcoins centers on their privacy - far removed from the prying eyes of Uncle Sam - but that may be an illusion. Last Thursday, New York's top financial regulator proposed the toughest restrictions on bitcoin companies to date. According to last Friday's Wall Street Journal, "the proposed license includes a long list of requirements for bitcoin businesses. Companies would have to provide extensive safeguards for consumers, including transaction receipts, disclosures about risks, and policies to handle customer complaints. Companies also would have to follow anti money-laundering rules, maintain a cybersecurity program, hire a compliance officer and verify details about their customers." Ouch! Another development at the Freedom Fest in Las Vegas was the announcement of a digital currency backed by physical gold. These "electronic gold" coins will compete with bitcoin and real gold. While it's nice to actual have some gold backing to an electronic bank account, we are old-fashioned enough to think that gold held in the hand, or a safe deposit box, is far more secure. Gold has stood the test of time in hundreds of global nations and historic cultures. The Internet is young and full of mischief. Cars are great, but 197 of the leading 200 car companies of 1920 went bankrupt by World War II. Computers are great, but nearly every "hot' 1960s or 1970s brand of computer (but IBM) died. One leading bitcoin exchange (Mt. Gox) has already gone bankrupt. Let the Internet coins compete, but we'll stick with gold. HARRY REID WANTS TO REGULATE INTERSTATE SALES AGAINSenate Majority Leader Harry Reid (D-Nevada) is at it again. He's trying to regulate and tax interstate and interstate Internet sales. After the House passed a permanent extension of the popular Internet Tax Freedom Act, Reid invoked an obscure Senate rule to allow him to bring to the floor a new bill allowing a permanent new authority for states and localities to force companies to collect sales taxes outside of their state. Amazon is behind this effort, since they hope to profit from selling the tax-collection software to companies selling across state lines. This onerous regulation not only requires dealing with 50 state tax auditors, but also hundreds of Indian tribes and potentially thousands of counties and cities, plus a handful of faraway U.S. territories and possessions, like Guam, American Samoa, Puerto Rico, the U.S. Virgin Islands and the Marianas Islands. Meanwhile, foreign vendors do not have to collect these taxes! We are fighting these unjust laws. There are now 31 states that charge no sales tax at all or have a partial or total exemption for taxes on the sale of precious metals or rare coins. Our company has worked with the Industry Council for Tangible Assets (ICTA) to try to spread this exemption to some of the other 19 states. We believe that U.S. coins are a form of legal tender and should not be taxed. Coins are also investments, which should not be taxed upon sale - just like stocks, bonds and other investments remain sales-tax free. There is no question that the imposition of sales taxes tends to depress a customer's interest in buying rare coins. They are as upset at this injustice as we are, so we need to continue fighting any added sales taxes. The good news is that leaders in the House of Representatives, I have personally met, support our efforts. DEMAND IN INDIA IS SOARING - DESPITE NO TARIFF RELIEFSpeaking of demand for physical gold, the volume of gold imports into India soared 65.1% in June (vs. June 2013) due to the anticipation of lower tariffs - which didn't happen. That's a strong indication that pent-up demand in India is reaching the boiling point. Indian buyers did not wait for tariffs to go down. They wanted to buy some gold now, presumably because they expect the price to rise in the fall. Exports of gold also rose, partly due to the requirement that Indian gold dealers export some of their gold to help improve India's balance of payments deficit, and partly due to an improvement in global gold demand. The World Gold Council (WGC) identified several other demand centers in its mid-year report, just released. Despite erratic demand in some markets, WGC says "interest in gold is gaining momentum. Net long positions in the futures market have gradually increased as short positions have been covered, ETFs [exchange-traded funds] have experienced inflows in recent months, and coin sales are increasing.” In addition, we are seeing a rise in tensions in several nations, notably Ukraine, Israel and Iraq. Gold has tended to rise and fall this year based on eruption of global tensions. RARE GOLD COIN PERFORMANCE CHARTSFor decades, I have liked better-date rare gold coins. I even wrote multiple NLG award-winning books about them. Currently I believe it is a historically opportune time to acquire select better-date gold coins in better grades. This week's graphs show how a portfolio of multiple or fractions of coins totaling $10,000 in different rare gold coins would have increased in value over the time indicated that I have purchased them. These graphs reflect the price gains of actual coins I have been fortunate to buy, showing an increase from $10,000 to as much as $60,000. Some series are trending upward and others seem to be at bargain levels to many experts. Segments of this market now remind me of the old oil filter commercial that said "You can pay me now or pay me a lot more later." I recommend at least a 5-10 year hold period on rare coin purchases as these graphs show impressive gains and volatility can occur during a shorter time span. We all know that past performance of some coins does not guarantee future performance for all coins. Many experts recommend buying better-dates and grades because of often better long-term performance for much of the past 100 years. Read my books to learn about famous successful long-term gold coin set builders like Louis Eliasberg. His set building provided him long-term benefits of diversification and significant premiums were later realized.

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |