Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

April 2014, Week 1 EditionGold traded under $1,300 per ounce last Friday for the first time since mid-February. The reasons cited by most experts continue to be (1) the lack of escalation (so far) in the Ukrainian crisis, (2) the threat of a possible slight increase in short-term interest rates a year (!) from now and (3) improving U.S. economic indicators, such as a slight increase in GDP growth from 2.4% to 2.6% last quarter. However, any reversal of any one of these three trends could send gold back up on its recovery path. In addition, any gold price correction is usually met by increased demand, especially in Asia and among U.S. coin & bullion buyers. The Wall Street Journal "Pans" Gold Again - Saying "Gold is Tarnished"We've commented in the past on how the mainstream media lists all the reasons why gold "should" go down - after it goes down. Friday's Wall Street Journal paints a picture of a suddenly risk-free world aligned against gold: "As Broader Fears Fade, Gold is Tarnished: Investors Pile into Riskier Plays as Ukraine Tensions Diminish, Fed Signals Interest Rate Increase; Why Invest in Gold?" That long headline pretty much summarizes the article's viewpoint, but it's amazing how any serious analyst with a straight face can talk about "easing of tensions in Ukraine" when Russian armies are poised at Ukraine's border. In addition to Ukraine and the Fed, the Journal says "a spate of good economic news has freshly undercut the rationale for owning gold, investors say. The U.S. economic outlook has improved, and Federal Reserve Chairwoman Janet Yellen said last week that the central bank was on track to raise rates next year." Between now and then, however, hundreds of economic indicators will be released and the data-hungry economists at the Federal Reserve will dissect those numbers looking for any reason to keep rates low. Already, this is the slowest post-war economic recovery (2.33% annual growth, on average, vs. 5.17% in Reagan's recovery, 3.34% in Clinton's recovery and 3.13% in George W. Bush's recovery). With the public debt rising rapidly, the economy could slow down drastically if the Fed raises interest rates, increasing the cost of serving the massive U.S. debt. The Fed wouldn't want to kill this recovery. The Wall Street Journal can be forgiven for being a cheerleader for stocks while "panning" gold, but the Journal's own pages report the truth - gold is up 7.8% so far in 2014, vs. a 1.5% decline in Dow stocks. Chinese Demand Starts 2014 with a Post-New Year's "Bang"Gold analysts were concerned that Chinese gold demand would peak in January, since the Chinese New Year fell on January 31 this year, but February demand has been even stronger. (March statistics are not yet available.) For the first two months of 2014, Hong Kong's gold imports are up 139.2% vs. 2013:

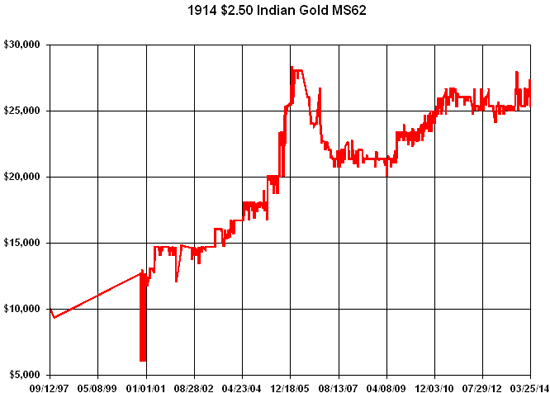

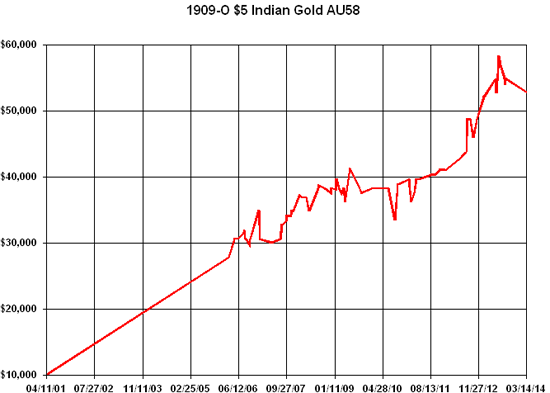

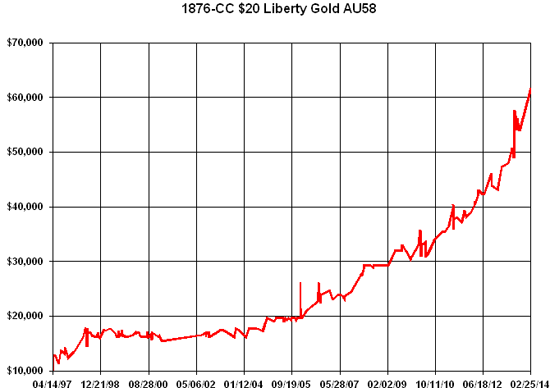

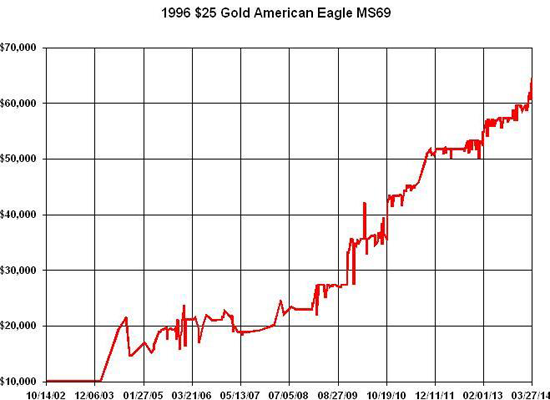

*Measured in metric tonnes; Source: Hong King Census and Statistics Department Note that February's post-New Year gold imports are over 30% higher than January's totals, even though February has three fewer days than January. In addition, internal demand is also escalating. The monthly withdrawal figures from the Shanghai Gold Exchange (SGE) show a 29% increase in the first two months of 2014. Koos Jansen, host of the China-based website "In Gold We Trust," reported that "Newly mined and stocked gold is moving through trade links in London - Switzerland - Hong Kong - into China." Last week brought two more indications of strong demand for gold and silver throughout the rest of Asia: (1) South Korea opened a new gold market last week, called the KRX, and (2) Singapore opened a 600-tonne silver vault, to meet the rising demand for secure silver storage, so Asian demand is still rising. An Update on Central Bank Gold BuyingThe CPM Group released its Gold Yearbook 2014 last week. CPM reported that central banks added 6.3 million ounces of gold to their foreign exchange holdings last year. That was the lowest level of central bank purchases since 2007, but we must also add that 2013 was gold's worst year since 1981 and its only down year of the new century, so it's quite encouraging that central banks did not sell their gold last year. This year, CPM says central banks will probably buy another 5.4 million ounces "as they come to expect gold prices to rise once more, stepping up their purchases." The CPM Gold Yearbook added: "Central banks remain interested in adding gold to their monetary reserves; they are just being value investors." In terms of tonnage, 5.4 million ounces represents only about 175 metric tonnes. To put that number in perspective, China has already imported more gold than that (192.8 tonnes) in the first two months of the year. Perhaps CPM is being too cautious. We shouldn't forget that many "emerging markets" are fighting massive currency erosion this year - more so than last year - so it is in their best interest to buy more gold to combat domestic inflation and political unrest at home. In that regard, the Central Bank of Iraq last week announced that it has just bought 36 tonnes of gold, worth over $1.5 billion at today's prices. Iraq made this massive move into gold in an attempt to stabilize their currency (the dinar) on foreign markets. At the end of 2013, the IMF says Iraq had only 27 tonnes of gold, so their 36-tonne purchase represents a 133% leap in their total gold holdings. Iraq's big move into gold represents the largest single gold purchase by any one country in three years. This one purchases exceeds the total annual demand (in 2013) for many large, more established nations, like France, Italy and the UK in Europe; Taiwan, South Korea, Malaysia, Singapore and Japan in Asia, or Brazil and Mexico in Latin America. Even with this big purchase, Iraq's total gold holdings amount to less than 5% of the country's foreign reserves, so they have plenty of room (and motivation) to buy more gold at today's relatively cheap prices. Rare Gold Coin Performance ChartsFor decades, I have liked better-date rare gold coins. I even wrote multiple NLG award-winning books about them. Currently I believe it is a historically opportune time to acquire select better-date gold coins in better grades. This week's graphs show how a portfolio of multiple coins totaling $10,000 in different rare gold coins would have increased in value over the time indicated that I have purchased them. These graphs reflect the price gains of actual coins I have been fortunate to buy, showing an increase from $10,000 to as much as $64,000. Some series are trending upward and others seem to be at bargain levels to many experts. Segments of this market now remind me of the old oil filter commercial that said "You can pay me now or pay me a lot more later." I recommend at least a 5-10 year hold period on rare coin purchases as these graphs show impressive gains and volatility can occur during a shorter time span. We all know that past performance of some coins does not guarantee future performance for all coins. Many experts recommend buying better-dates and grades because of often better long term performance for much of the past 100 years. Read my books to learn about famous successful long-term gold coin set builders like Louis Eliasberg. His set building provided him long-term benefits of diversification and significant premiums were later realized.     Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |