January 2026 - Week 3 Edition

The WGC Says India is Helping Drive Precious Metals Prices Up in 2026

In early 2026, we have seen record inflows into Indian gold ETFs, according to Kavita Chacko, the Head of Research for India at the World Gold Council (WGC). In last week’s WGC update, she said gold is rising due to geopolitical uncertainty: “Gold prices have extended their uptrend in 2026, scaling fresh record highs … International gold prices advanced by nearly 6% in the first 13 days of the new year, registering five new all-time highs and breaching the US $4,600/oz mark. This follows a 4.2% rise in December and a strong 67% gain during 2025, the highest annual increase since 1979.”

The WGC report continued, citing gold ETF demand reaching new heights at the end of 2025, as net inflows reached an all-time high of $1.29 billion in December, “the eighth consecutive month of net additions,” she wrote. “Investor appetite was supported by muted equity market performance and sustained gold price momentum, reinforcing the role of gold ETFs as a preferred portfolio diversifier.”

Also, India’s ETF investor base rose 60%, year-over-year, in the number of accounts. There were 3.8 million new gold ETF accounts added in 2025, “underscoring the growing adoption of gold ETFs.”

Gold ETF demand is also rising in North America, following four full years (the Biden years, 2021 to 2024) of net gold ETF selling. The best ETF gold buying year was the COVID-19 year, 2020, but then came a four-year drought of North American Gold ETF demand, according to the World Gold Council. In 2025, however, Gold ETFs saw a net inflow of $82 billion (equivalent to 746 metric tons) through November.

We don’t yet have the full data on central bank gold buying but we are close to seeing the fourth straight year of net central bank gold buying of 1,000 metric tons or more – a major source of annual gold buying.

Coin of the Week

My favorite $2 ½ Indian in MS-64 grade is the 1910. The Smithsonian’s National Museum of American History only has an MS-63 in its collection, so you could say you have a coin better than the one in the Smithsonian. It has been a 20/20 Program coin since we began this groundbreaking system of finding the coins with the best capitalization, rarity and condition and it has increased in value by over 100% over the past 6 years.

The 1910 2 ½ Indian has the distinction of having the lowest capitalization (population times price) of any $2 ½ Indian in MS-64. I highly recommend you add one of these beautiful, historical, uniquely incused gold coins to your portfolio. You will be glad you did!

Trump’s First Full Year in Office – Defying the Skeptics as Metals Soar

This week marks President Donald Trump’s first full year in office. When he took the oath of office on January 20, 2025, the Congressional Budget Office (CBO) consulted its crystal ball and predicted 1.9% GDP growth in 2025, down from 2.3% in 2024, and then 1.8% annual growth for each of the next nine years. The proverbial crystal ball was wrong.

Once again, this brain trust of supposedly “non-partisan” (but mostly Democrat) PhD economists were incorrect. After a slow first quarter – when Joe Biden’s policies dominated – we have seen growth of over 4% in the final three quarters of 2025 – more than double the CBO’s predictions. The Fed did even worse, as the U.S. Federal Reserve’s 400 PhD economists predicted only 1.7% GDP growth in 2025.

The Atlanta Fed division is smarter than many other sources when it comes to measuring GDP. They take the components of the GDP to create a model of what is actually happening and their forecasts are usually well above other “experts.” For the final quarter of 2025, they currently see 5.3% annual growth rates vs. a morbid 1% growth for that quarter forecast by the average of some of the most reputable “Blue Chip Economists.”

Turning to inflation, the government-funded pundits in DC were also way off base a year ago. At the start of 2025, the Fed forecast 2.9% inflation but all through the year, Fed Chair Jerome Powell (and other Fed governors) warned of rising inflation rates “coming soon” due to President Trump’s various rounds of tariffs. However, at the end of the year, inflation was 2.7% lower than during any of the Biden years.

This past Tuesday, the Labor Department announced that the December Consumer Price Index (CPI) rose 0.3% in December and 2.7% over the past 12 months. Excluding food and energy, the core CPI rose 0.2% and 2.6% in the past 12 months, slightly better than the economists’ estimate of 0.3% and 2.7%, respectively. The November Producer Price Index (PPI) rose by 0.2% and 3% in the past 12 months but this was below economists’ consensus expectation of 0.3% and much of the price increases were related to energy.

While in Detroit on the same day as the Labor Department announcements, President Trump explained his economic results: “We have quickly achieved the exact opposite of stagflation, almost no inflation and super high growth.” Regarding Fed Chairman Powell, President Trump said, “That jerk will be gone soon.” He also mentioned the Atlanta Fed had increased its fourth-quarter GDP estimate to a 5.3% annual pace, up from 5.1% previously reported.

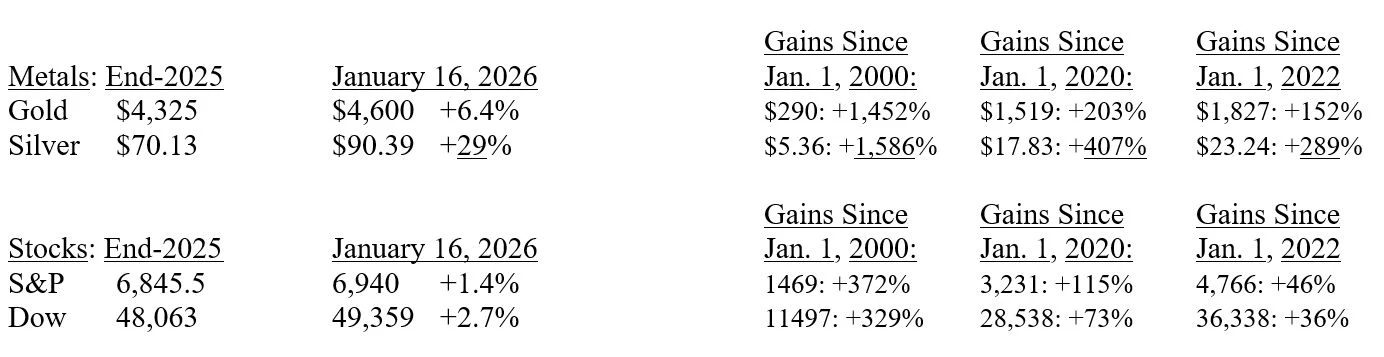

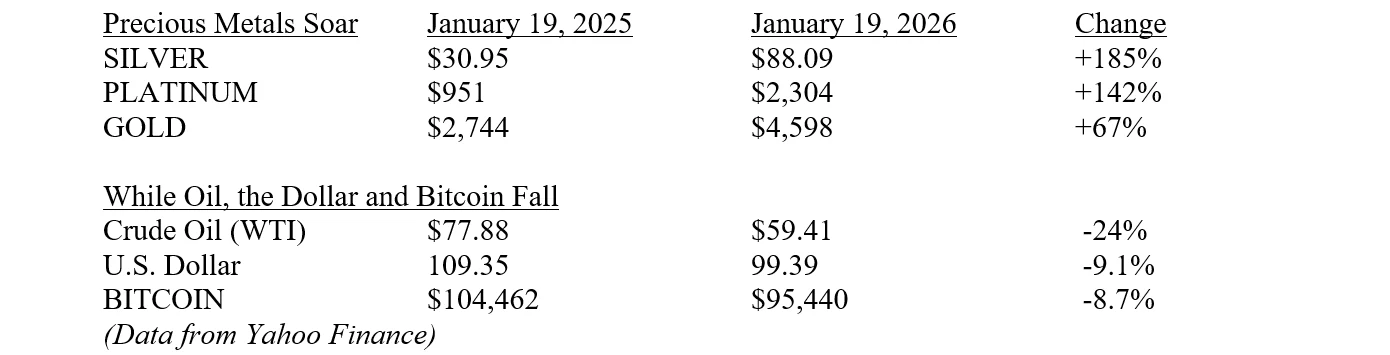

Over the past 52 weeks, precious metals have trounced all paper currencies – plus bitcoin and crude oil.

Silver is still soaring, exceeding $90 per ounce this past week and up 29% in the first two weeks of 2026, after a record-setting growth spurt in 2025. More billionaires like Elon Musk, Ray Dalio and top investment strategists have expressed concerns about China’s restrictions on the export of critical metals, like silver, calling this a serious threat to critical supply chains. Silver – for the first time in over a decade – now leads gold in all three of our performance timelines, above. The gold-to-silver ratio has been cut in half, from 100-to-1 ($32 silver vs. $3,200 gold) to just 51-to-1 now ($90 silver vs. $4,600 gold). Most other commodities are flat or down but not silver or platinum (+12% so far in 2026) and gold is +6.4% so far this year vs. about 2% growth for stocks.

Metals Market Report Archive >

Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher.