Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

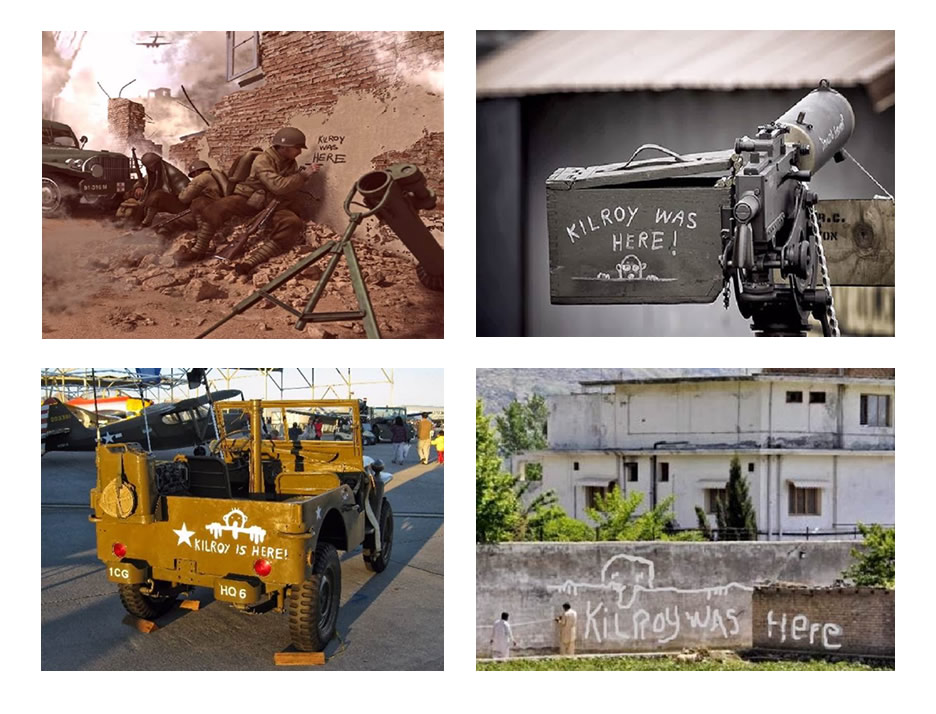

Ed Reiter, Executive Director,

May 2023 - Week 4 EditionGold Still Poised for Strong GainsGold is patiently waiting – as is the stock market – for a resolution to the “debt ceiling” debate, not to mention the Russian/Ukraine conflict, the banking crisis and several other major unresolved issues. While holding steady, it is important to realize that gold is beating the stock market this year by more than is evident in the statistics we quote here each week. Gold is up over 9% while the Dow is down slightly (-0.3%), and the S&P 500 – where each stock is weighted equally – is relatively flat (+0.04%), even though the size-weighted S&P is up nearly 8%. That’s because indexes give extra weight to big stocks. Just seven high-flying high-tech stocks account for 25% of the weighting of the S&P 500 and an astounding 54% weighting in the NASDAQ 100 stock index, so some stocks are obviously “more equal than others.” Kilroy Was EVERYWHERE! All Hail U.S. Veterans on Memorial Day! -- Especially Those Few Remaining World War II Vets, Now Near 100!The name “Kilroy” was known to every soldier in World War II. He was everywhere, but where was he? Nobody knew. And that was the joke. But he is now engraved in stone on the National War Memorial in Washington, DC, in a small out-of-the-way alcove where few have seen it. It’s worth seeing this Kilroy. Who was Kilroy? Now we know. Since nobody knew, in 1946, the American Transit Association, through its radio program, “Speak to America,” sponsored a nationwide contest to find the “real Kilroy.” They demanded proof in exchange for a real trolley car as grand prize. Almost 40 men made the claim, but only James Kilroy of Halifax, Massachusetts supplied ample evidence. In the war, he was too old to fight (46) so he was a shipyard worker at the Quincy Shipyard. Each rivet checker put their “mark” to get credit, but some riveters would erase one mark and put their own, in effect stealing the other guy’s pay. The Boss got wind of this, so Kilroy got the job of inspecting rivet marks, putting the right mark and his own approval, “Kilroy was here” in waxy chalk. Later, American soldiers are believed to have added the “nosy” bald figure, predating Kilroy and known in Great Britain as Chad, peeking over a wall at cheaters! Once these planes and parts started showing up in battle, everyone started copying Kilroy’s artwork. Here are just a few examples:

After the war, to prove his claim, James Kilroy asked officials, riveters and workmates from the shipyard to verify his story and they did. He won the trolley car, which he gave to his nine kids as a Christmas gift. They set it up as a playhouse in Kilroy’s yard in Halifax, Massachusetts. James Kilroy died in 1962. Later, Kilroy’s iconic nose and scalp appeared atop Mount Everest, on the moon, on the Statue of Liberty, the Arc de Triomphe in Paris and even at the spot where Osama bin Laden met his fate: God Bless all our Veterans on Memorial Day! Gold and Silver Are Also Beating Their Real Competition – Currencies and BondsWe regularly compare gold and silver to the major stock indexes here each week, but gold and silver are not really designed to compete with stocks of good companies, which still belong in nearly every portfolio. The major role of gold is to balance stock positions and to compete with cash savings in paper currencies when it comes to wealth preservation. Gold also competes, to a lesser extent, with bonds (both government and corporate) since bonds will erode in value with inflation. Now, is a good time to call your professional account representative and ensure you are well-positioned with gold. In that regard, gold has doubled in the past 10 years in euro terms, and gold is up 80% in the past five years in euro terms. In dollar terms, gold is up 53% in the past five years, about the same as the S&P 500 and 50% more than the Dow (at +36%). In the past 3-plus years, since the advent of COVID-19, stocks have slightly outpaced precious metals, but metals have swamped the values of all the currencies:

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |