Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

April 2023 - Week 4 EditionGold Holding Steady Ahead of Expected LaunchGold will likely trade in a “dead zone” this week, just under $2,000 per ounce, awaiting the decision of next week’s Federal Open Market Committee (FOMC), which will likely raise short-term interest rates for the 10th consecutive time – this time by just 0.25%. It is possible they will either “pause,” or even announce that they are done raising rates for now but this is a minority position among voters. With a likely recession looming, banks facing liquidity crises, real estate unaffordable for many Americans, and the dollar losing its edge in global trade, the Fed has much to consider when they meet again next week. Why the Dollar is Sinking, and What it Means to Gold’s FutureThere have been many important stories lately about why the dollar’s recent decline on the world stage is important, but few have concentrated on what this means to American global leadership or the future of gold. I recommend one brief and helpful article published last week by Sarah Arnold in Town Hall, “Why Americans Should Worry About the Dollar.” She outlines the fact that the dollar could lose its century-long status as the world’s primary reserve currency as Communist China aggressively begins to use their yuan in commodity contracts with leading trading partners. The U.S. Dollar Index has fallen 10.8% in the last seven months, and about 3.7% in the last two weeks as talks about the looming “debt ceiling debate” reach an impasse, posing a risk for the dollar’s credit rating in foreign markets if there is a debt default. Right now, the Treasury Department is resorting to “extraordinary measures” to prevent America from defaulting on its rotating debt obligations after already reaching its debt ceiling at the start of 2023. House leader Kevin McCarthy has put forth a fairly austere spending package but President Biden will not back down from his high-tax, high-spending package. So, there is no middle ground for negotiations in sight. The last time there was a threatened debt default in a debt ceiling debate, gold soared 25% in two months in 2011. More importantly, when the dollar falters and no other currency takes its place, gold will be king. I’d advise adding more gold to your portfolio now before anticipated price increases later this year. Call your professional account representative today. The “Bailout” Era is Back for Zombie Banks: New Money Creation “To Infinity and Beyond”Another “red flag” facing the Fed is that it has suddenly started to wind down its “quantitative tightening” (QT) program and is re-entering a new “bailout” mode for Zombie banks. The Fed’s money-shrinking diet was short-lived, as they are now back to printing “as much money as is needed” to stabilize banks. This plan was drafted suddenly, over a weekend, following the failure of Silicon Valley Bank on Friday, March 10. On Sunday morning, March 12, Treasury Secretary Janet Yellen told CBS’ “Face the Nation” there would be no bailouts after the failure of Silicon Valley Bank the previous Friday. Later on, that same day, the Federal Reserve declared bailouts would be unlimited in their new Bank Term Funding Program (BTFP), providing relief to “Any U.S. federally insured depository institution.” Payments would be at “100% of par value” rather than a “mark to market” bid value, meaning long-term bonds would be paid at full value. This move took all risk out of bond investing – like paying stock investors a profit whether their stocks rose or fell. With this in mind, a company called Seeking Alpha took the bond holdings of six major banks as of March 12, and showed what their share price loss would be without this special bailout:

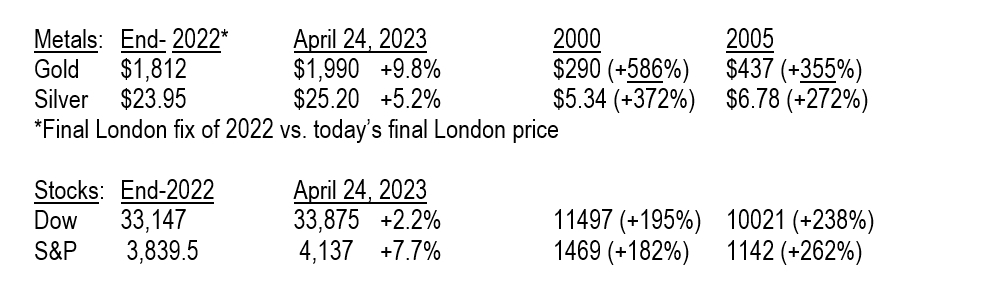

Instead, most big bank stocks (except Signature Bank and SVB), rose in price over the past month, due to implied bailouts, but the dollar is significantly down in the wake of the “bailout to infinity and beyond” offer for all banks. Here is the price list for the precious metals vs. currencies over the last seven weeks:

The new “Zombie Bank” era – of big banks kept alive by massive new Federal Reserve infusions of cash will likely keep the dollar weak, other currencies stronger and gold rising even faster. Again, now is the time to call your professional account representative to avoid missing out on this expected gold price increase.

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |