Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

March 2023 - Week 2 EditionFed Interest Rate Hikes Hurting Gold and American WorkersGold rose $20 on Friday, March 3, from $1,838 to $1,858 and stayed there over the weekend before falling to $1,845 on Monday. Silver also rose sharply, up 2% on Friday, then settled just above $21. Then came the testimony of Fed Chairman Jerome Powell on Tuesday (before the Senate) and Wednesday (at the House), which – as often happens – sent both stocks and gold down. The Fed’s next monetary policy meeting will be on March 22, so investors were looking for more clues from Powell, and the Fed chair came across gloomy in promising more rate increases, then indicated holding rates “higher for longer.” The continued interest rate hikes are supposed cool the economy but evidence produced in Congress on Wednesday showed they lead to higher unemployment as companies cut workers to save money and hurt Americans by increasing their debt burdens and sending investments spiraling. Gold and silver have been hedges against rate hikes in the past but Powell’s recklessness is even affecting precious metals. Two years ago this week (March 9, 2021), when gold was $1,720 and the Dow was 32,000, I wrote this: When Interest Rates Go Up, Gold Usually Goes UP, Not DownThe pundits keep getting this wrong, but they keep saying (in press reports) that “gold goes down when interest rates go up since” (they say) “gold pays no interest and therefore it can’t compete with interest income,” but in nearly all the historical instances of rising interest rates, gold went UP, not down.

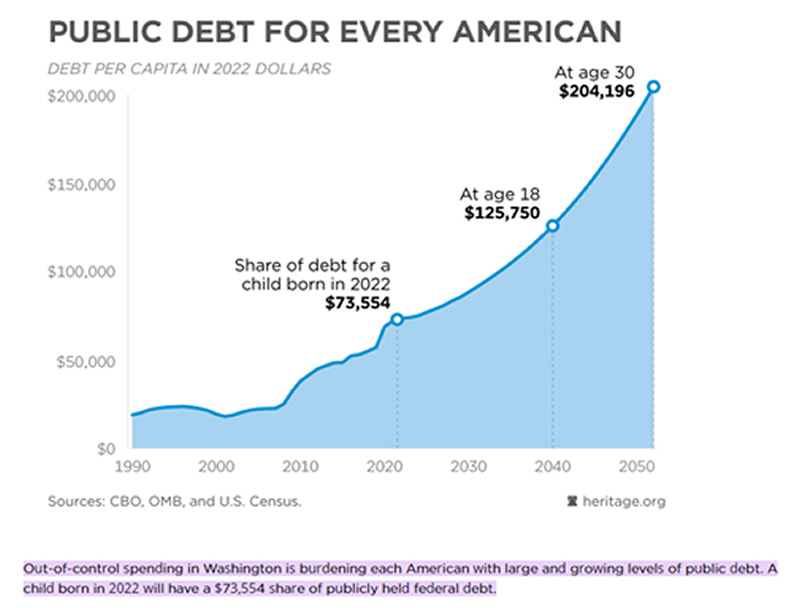

The way to understand this anomaly is that higher interest rates anticipate higher inflation, which will lift gold at a faster rate than either inflation or interest rates can match, and once a few investors realize that fact, the gold market will begin to take off. The gold market is much narrower than stocks, bonds or global currencies, so a small amount of buying in the gold market can move gold far more than it can move stocks, bonds or currencies. Historically, gold and the dollar have moved in opposite directions, but that has been a shaky correlation over the last year due to COVID-19 putting a damper on the “velocity” of money – how fast it is spent. Consumers and investors have tended to sit on their stimulus money rather than spend it, so inflation has not erupted except in the stock market, real estate and Bitcoin. We’re about to face reality with inflation. Fed Chair Jerome Powell says there is virtually no inflation and that any inflation we may face will be “transitory,” but President Biden plans to do away with fossil fuels and concentrate on underwriting inefficient forms of fuels that must be underwritten by taxpayer funding. --- Now two years later, with short-term interest rates up from near-zero to nearly 5%, gold is up 5.6% the Dow is up only 2.5% in the same time period, and the Fed was totally wrong about “transitory” inflation. It’s still early in the re-inflation cycle as Powell promises more increases. So, contact one of our professional account representatives today to add more precious metals to your portfolio. Another indicator of the long-term erosion of the dollar is the huge growth in deficit spending…. President Biden is Presenting a Spendthrift Budget Relying on Tax Increases for FundingIt’s a little ironic to watch the House and Senate members grill the Chairman of the Federal Reserve for his monetary policies this week – like Massachusetts Senator Elizabeth Warren accusing him of putting two million people out of work with his high-interest rates – when it is Congress and the President that caused the Fed to print those trillions of dollars to fund the programs which they, Congress and the President, mandated. Very soon, President Joe Biden will present a budget to Congress which relies on vast new spending plans with no major cost-cutting. They will pay for those plans with tax increases on “the rich” – many of those earning under $400,000, whom he promised never to tax, during his campaign for office. Congress has its part, either in rejecting this budget or in crafting its own more responsible cost-cutting budget in the House. We are already well past the point where our accumulated debt (over $31 trillion) has passed the annual GDP ($23 trillion). The only other time this happened was at the end of World War II, when we fought a global war to save Europe and Asia, across two oceans, spending and borrowing every dime possible. We paid most of that borrowing back over the following 20 years, as the King Dollar (and gold) ruled the postwar world until about 1965, when war spending and inflation began to erode the dollar once again. After the Cold War ended, through a combination of peace, prosperity and cooperation between Parties, Washington balanced the budget between 1998 to 2000, and gold dropped to $255. The national debt was under $10 trillion. Then came 9/11 and massive budget deficits again. Gold soared. The federal government has run a budget deficit every year since 2000, forcing it to borrow money and add to a debt that now runs at $31.5 trillion, with trillion-dollar-per-year budget deficits for as far as the eye can see. History has proven that raising taxes won’t raise revenues. Actually, lowering top tax rates raises more revenues – as the Kennedy/Johnson, Reagan, Bush and Trump tax cuts all showed – but Biden will try to sell the populist message of tax increases to a Republican Congress. We need the Republicans to hold firm against that. In the meantime, as the budget deficit increases exponentially, Congress and the President will rely on the Fed to “solve inflation” by raising rates, causing higher deficits in a vicious circle, which will devalue the dollar further and keep pushing gold’s value higher in dollar terms over time, as it did in similar debt cycles in the 1970s and early 2000s leading to bull markets in precious metals and rare coins. Be sure to call your account representative to construct a strong position in precious metals.

Are our elected officials that far out-of-touch with reality that they can’t start working on slashing debt instead of spending more? When our leaders live in a delusional state and refuse to face the obvious truth, history has a habit of repeating itself in a bad way. If you can, write your congressman and/or senator and tell them you don’t want your grandkids to pay for the unforgivable financial mismanagement of today. There will be a breaking point, but it doesn’t have to be. Spread the word. Let’s balance the books.

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |