Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

June 2020 - Week 3 EditionGold in Comex Coffers Nearly Quadrupled in the Last Three MonthsAccording to an article in last Thursday’s Wall Street Journal (“Scramble for Gold Redraws Market’s Map,” June 11), gold imports to New York from Switzerland and elsewhere have been massive over the last three months. As we’ve written here in the past, one major factor in the current gold shortage stems from the fact that major Swiss gold refiners were only sporadically open from March through May due to coronavirus fears - three of the four major gold refiners were in the southern, Italian-speaking Swiss cantons, near northern Italy, which was hard hit by the coronavirus.

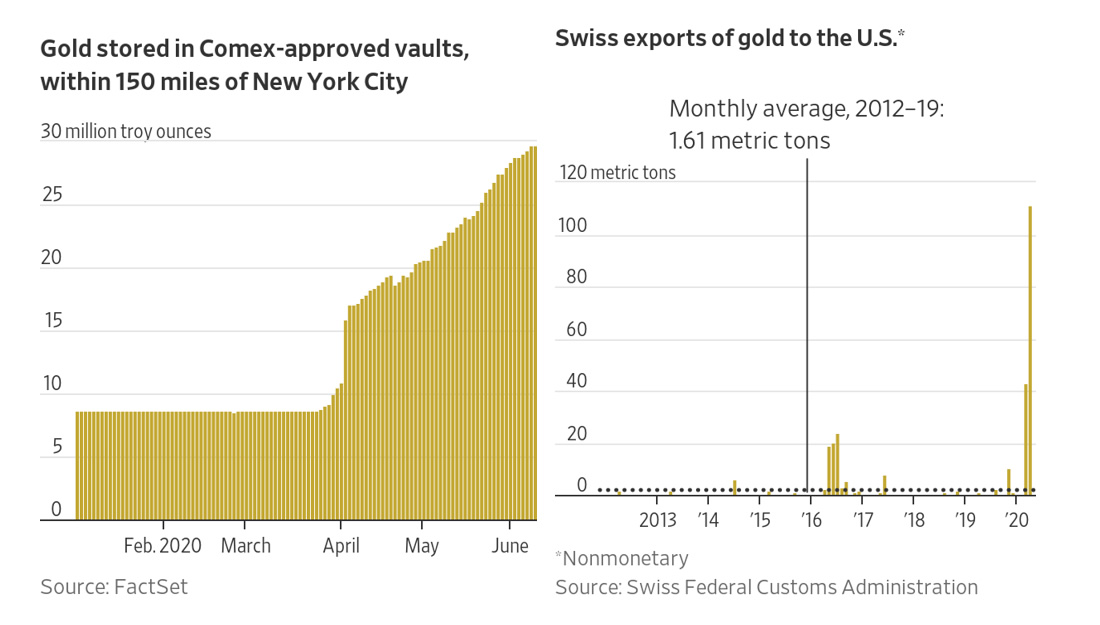

The Comex division of the New York Mercantile Exchange is required to hold physical gold to back each new share of gold ETFs that investors buy. Due to stocks falling sharply, demand for gold ETFs nearly quadrupled. Gold in Comex vaults within 150 miles of New York City rose from about eight million Troy ounces (250 metric tons) to almost 30 million troy ounces of gold (over 900 metric tons), according to FactSet. The Journal says that rise in gold vaults is equal to nine fully-loaded Boeing 737-700 airliners. Since commercial flights out of Switzerland were limited during those months, the Journal said private charters by logistic firms flew that gold from Europe to New York. Stocks are now going up and down rapidly – more rapidly than at any time since the 89% decline from 1929 to 1932, followed by a rapid 93% recovery during the summer of 1932. So far, the year 2020 is a year of unprecedented volatility – the widest price swings since 1929-1933. That’s all the more reason why investors are turning to gold – the only investment that went up during the troubled 1930s. To learn more about how to properly invest in gold, call our friendly and experienced account representatives that are the heart of Team Mike! Wall Street Journal Lists Gold as Top-Performing Asset Last WeekThe Wall Street Journal listed gold as the top performing asset last week, when comparing stock indexes, currencies and commodities. In their June 13-14 edition, Gold was listed at +3.17% for the week. The worst-performing assets were U.S. stocks, led by the S&P 500 energy sector at -11.07%. For the year-to-date, gold beat stocks by a large margin, up over 14% vs. -8.8% for the Dow and -4.2% for the S&P 500. Update on Project 2020 – Our Targeted Plan for Stockpiling Tomorrow’s Winners TodayWe’ve been trying to “quietly” assemble an inventory of what we think will be tomorrow’s top rare coin winners – based on several factors, including sheer beauty, historical importance, popularity and low population capitalization (that’s a coin’s value multiplied by the number of coins in a specific grade). We’re finding that it’s becoming harder to acquire rare coins quietly, as these coins are becoming tougher and more costly to buy. The market for many gold coins priced under $10,000 is definitely rising! Civil War-dated and Carson City-minted coins are in especially high demand. Over the last few months, we have posted over $2 million in higher bids (above any other dealer’s bids) on hundreds of different coins in our attempt to corner the finest specimens of lower-mintage, low-population $10 and $25 Gold American Eagles, $2.50, $3.00, $5.00 and $10.00 Indians, Type II and Type III Liberty Gold, and the best classic Commemorative halves. But even our higher bids are attracting fewer and fewer offers! Although our bids on many of these coins are consistently rising, we continue to invest in these coins because we believe they are still underpriced relative to their population capitalization. In the process of accumulating these coins, we scrutinize each coin very carefully. We never sacrifice in our quest for top quality. We buy only hand-selected, top-quality specimens. That is why you should only buy rare coins from well-recognized experts. Each coin should have good eye appeal. When you see these coins, you will understand what I mean. Each coin is a classic piece of American history. Owning these coins is like holding history in your hands. Call your Team Mike representative for a description of our fresh and quickly changing inventory of classic American gold and silver coins, but you must act quickly. As a numismatic mentor of mine used to say, there is a difference between a “fast” rabbit and a “dead” rabbit. When gems come into our inventory, they tend to move fast. That’s when you want to be a fast rabbit.

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |