Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

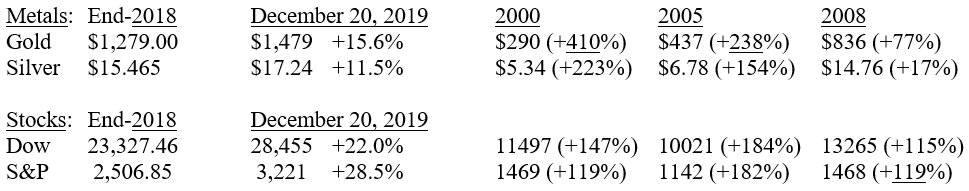

December 2019 - Week 4 EditionGold Up 15.6% in 2019Gold rose $12 in the last week and is up $25 since Thanksgiving. Silver is back above $17 after being below $17 during most of December. If gold closes above $1,441, then 2019 will be the best year for gold since 2010, when it gained 29.2%. Looking forward to 2020, gold has a superb track record during the last five Presidential election years. It has also performed well during the impeachment threats against former Republican Presidents Nixon and Reagan, and during stock market crashes in their second terms.

With the stock market at or near unsustainable highs, we may see another stock market crash and gold bull market during the coming election year or early in President Trump’s second term – and especially if a radical Democratic President wins the White House (and/or both houses of Congress) in 2020. Gold is life insurance for the rest of your portfolio. Call us today!

When Stocks Fall Fast, Gold Usually Rises Just as Fast

I told you a few weeks ago that many millionaire investors are afraid of this stock market. I cited a survey of 3,400 millionaire investors (those with at least $1 million in investable assets) by UBS, a Swiss investment bank, which found that more than half of them think that there will be a “significant market sell-off” by the end of 2020. They had already moved an average 25% of their portfolio into cash.

Now, we have confirmation that this movement into cash is far more widespread than just the millionaire class of investor. In the weekend edition of December 7-8, 2019, The Wall Street Journal showed evidence that the bulk of investors have pulled out over $220 billion in stock market mutual funds and exchanged-traded funds (ETFs) through the first 11 months of 2019, a record high exit for any full year.

All that money is flowing into cash more than bonds or gold. During the past three years, assets in money market funds (cash on the sidelines) have grown by about $1 trillion, according to the Lipper division of Thomson Reuters, as cited by the Journal’s December 8 article. Money market fund balances are now at their highest level since the 2008-9 Great Recession. Although many big institutions are still in the stock market, the public is afraid of the market and is ready to invest in something else with their pile of cash.

Many big institutions are confident that President Trump will escape impeachment conviction and will be re-elected, but at the same time they warn that the stock market could decline 25% or more if a socialist candidate like Bernie Sanders or Elizabeth Warren were elected. In such a case, gold is life insurance for the rest of one’s portfolio. In past stock market crashes gold has gone up rapidly as stocks have fallen.

Here are some examples of gold’s increase during stock market crashes of the last 50 years:

It’s important to realize that when markets start falling, the money “on the sidelines” starts moving into gold, and some of those selling stocks move into gold as well. Then, experience shows that a reasonable percentage (about 20%, or one in five) of those bullion customers move on to become interested in rare coin purchases over the following years. That has led to rare coin bull markets in the years following stock market crashes beginning in 1973, 1976, 1987 and 2007. Now is the time to add more gold investments to your portfolio! Call us today!

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |