Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

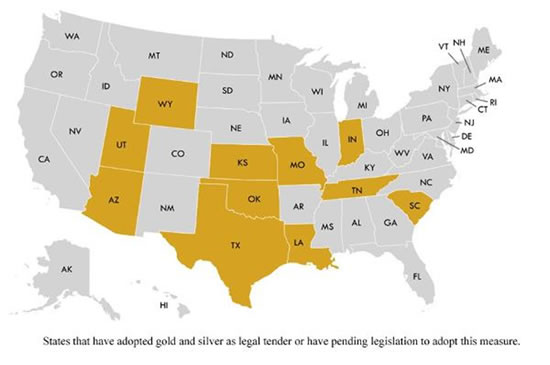

May 2017 - Week 5 EditionSilver Supply/Demand Curve Begins to Turn in Silver’s FavorLast week, the Silver Institute and the research team from GFMS at Thomson Reuters said that silver mine production declined in 2016 for the first time since 2002. The gap between supply and demand also turned negative with 1,007.1 million ounces of supply and 1,027.8 million ounces of demand, creating a 20.7 million-ounce deficit, which puts upward pressure on silver prices. The largest five silver producers, in order, last year were Mexico, Peru, China, Chile and Russia. On the demand side, industrial fabrication made up over half (55%) of the demand – 562 million ounces. Jewelry was a distant second at 207 million ounces (20%), while coins and bars accounted for another 206.8 million ounces (20%). The final 52 million ounces (5%) of demand came primarily from silverware and other decorative uses. Unlike gold, silver is an industrial metal as well as a precious and decorative metal, so the new industrial applications for silver provide the biggest boost in the demand curve. Last year, for instance, demand for silver in photovoltaic applications rose 34% to over 76 million ounces, driven mostly by a 49% increase in solar panel installations last year. At one time, investors feared what would happen to silver when the photographic process no longer demanded so much silver, but technology always moves forward, not backward, so these new industrial applications of silver have taken the place of photographic demand. As of May 25, 2017, the U.S. Mint has reported that sales of the American Eagle silver bullion coin during May have already doubled the sales total of April. Sales in 2017 were heaviest in January, the first month the 2017 coins were available, but sales lagged in February through April before reviving in May. Month in 2017 American Eagle silver coin sales (ounces) January 5,127,500 These figures are down from 2016, when sales averaged over four million ounces per month through May, but the recent silver rally could cause more investors to look into buying silver Eagles this summer. Gold and Silver RisingGold rose again last week and silver rose even faster, in percentage terms, as investors are beginning to notice the supply/demand curve favoring silver. On Tuesday May 30, after the Memorial Day weekend, silver rose 5-cents while gold fell $4. This is unusual. In recent months, gold has outperformed silver, but silver may rise faster now, for reasons outlined below. Last week, both metals rose, despite the fact that notes from the Federal Reserve’s latest Open Market Committee meeting expressed the likelihood that the Fed will raise rates 0.25% on June 14. Over 85% of investors are now betting on a rate increase. The Amazing Return of Constitutional Money in the United StatesThey say that gold is a “barbarous relic” and the Constitution is a “dead letter,” but more and more states are coming to realize the power of a “secret formula” for sound money in the U.S. Constitution. Article 1, Section 10 states “no state shall…make anything but gold and silver coin a tender of payments in debt.” We now have seven states acknowledging that successful financial formula in their state laws. Last week, Arizona Governor Doug Ducey signed a bill into law which makes gold and silver legal tender in the state as of August 9. This makes Arizona the 7th state to pass a law acknowledging gold and silver as legal tender. Four other states are considering similar measures. In addition, Utah and Texas are taking up measures to set up state-run depositories to help private investors keep their gold investments secure. Here is a map of the 11 states with current or pending legislation to adopt gold and silver as legal tender:

Since the Federal Reserve was formed in 1913 and the “hoarding” of private gold coins was outlawed in 1934, the U.S. dollar has lost over 98% of its purchasing power in terms of the golden constant. This paper money experiment has been tried and found wanting, as reflected by this wave of new state laws.

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |