Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

May 2017 - Week 2 EditionLong-term U.S. Interest Rates are FALLING, not Rising, Favoring GoldWe have shown how the mainstream media pundits are wrong about gold vs. short-term interest rates. Whenever the Fed raises rates, gold rises, confounding the theorists who say that gold doesn’t offer interest income and therefore cannot compete with rising rates on short-term cash. We have pointed out that short-term rates are still ultra-low, under 1%, but a more important reason is that long-term interest rates are falling – and it is those long-term rates that “handcuff” the Fed from raising short-term rates too fast. Since mid-March, the 10-year Treasury rate has declined from 2.62% to 2.35%, while the 5-year Treasury rate has declined from 2.14% to 1.88%. These long-term rates are declining since the U.S. economy has been in weak condition (rising only 0.7% in the first quarter) and since the U.S. is running up larger deficits with increased spending programs vs. lower tax revenues due to a slower economy. The Consumer Price Index (CPI) is up 2.4% over the last 12 months, so the “real” interest rate return for investors in cash is below zero. If investors select a 5-year Treasury bond at 1.88% interest, they are losing half a percent per year (to inflation) in “real” terms. If they select a bank CD or a short-term Treasury Bill, they are losing about 1.5% after inflation. As Frank Holmes of U.S. Global Investors (a mutual fund firm) has long argued, gold tends to rise when the “real” (after inflation) return on cash is negative, as it is now. So if you want a clear idea about whether the Fed will raise short-term interest rates, keep an eye on the trend of long-term rates, which are set by the bond MARKET, not by the Fed. Gold Declined Last WeekGold declined $40 last week when the Federal Reserve opted not to raise rates in their May 2-3 meeting of the Federal Open Market Committee (FOMC). Recent experience has shown that gold tends to go down before the FOMC meets, but then gold tends to rise when the Fed raises rates, contrary to what most pundits have predicted. There was also a strong jobs report on Friday. In addition, the mainstream French candidate beat the populist Marine Le Pen by almost 2-to-1 on Sunday, causing some to sell gold. I Speak About Gold Investing at the NRA ConventionAt the National Rifle Association’s national conference in Atlanta I visited briefly with Donald Trump, Jr., Sheriff David Clarke, Dana Loesch and Wayne LaPierre. With an attendance of over 81,000 people, it ranked second only to the 86,223 that attended the 2013 NRA Annual Meetings & Exhibits in Houston. President Trump spoke at the event, and was the first President since Reagan to do so.

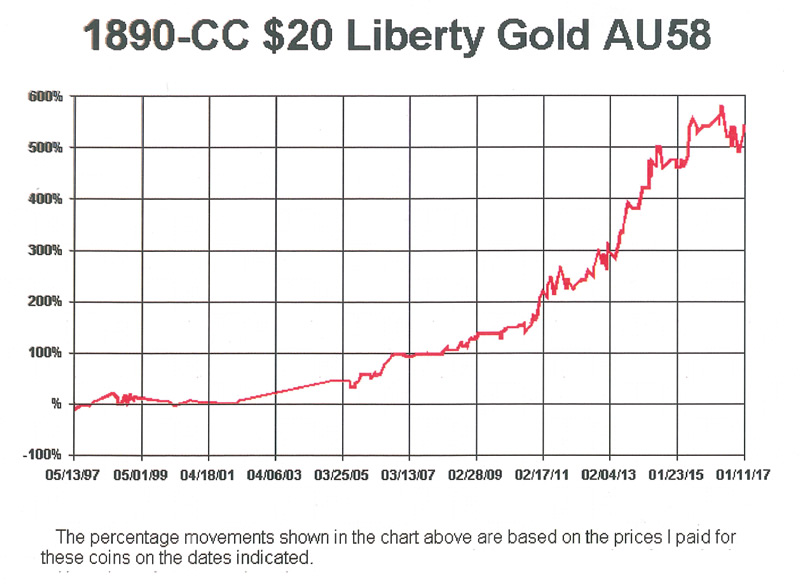

In addition, our booth offered copies of my acclaimed book, Type Three Double Eagles 1877 – 1907, 2nd Edition, which received the Book of the Year Award from the prestigious Numismatic Literary Guild. One of the highlights of that book is a series of charts for many issues of Type Three Double Eagles. There has been particular interest in the Carson City (CC) issues, beginning with the 1870-CC, with impressive price gains. There is something about the lore of the Wild West in these $20 Carson City gold coins. They weren’t minted every year and are very lustrous, beautiful specimens. For those interested in history and gold, this book is essential for any gold coin collector and investor. Call us to acquire one and I will autograph it.

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |

I also co-hosted a workshop on the best ways to buy, sell and store gold and add precious metals to a diversified portfolio. I began by speaking about how the Trump administration has helped to boost the price of gold and increase consumer interest in gold. We’ve certainly seen sporadic increases in new customers buying gold as well as existing customers purchasing more expensive coins since Trump was elected. We had more people come by our booth than at any prior NRA Meetings and Exhibits. As the Official Bullion and Rare Coin Expert of NRA Publications, our company also co-sponsored the NRA Prayer Breakfast on Sunday attended by over 1,000 people. The featured speakers were our own Forest Hamilton and former member of the U. S. House of Representatives, Allen West.

I also co-hosted a workshop on the best ways to buy, sell and store gold and add precious metals to a diversified portfolio. I began by speaking about how the Trump administration has helped to boost the price of gold and increase consumer interest in gold. We’ve certainly seen sporadic increases in new customers buying gold as well as existing customers purchasing more expensive coins since Trump was elected. We had more people come by our booth than at any prior NRA Meetings and Exhibits. As the Official Bullion and Rare Coin Expert of NRA Publications, our company also co-sponsored the NRA Prayer Breakfast on Sunday attended by over 1,000 people. The featured speakers were our own Forest Hamilton and former member of the U. S. House of Representatives, Allen West.