Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

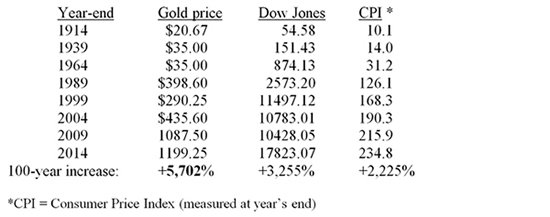

April 2015 – Week 2 EditionGold rose $27 on Wednesday, April 1, rising from $1180 to $1207 in less than eight hours in reaction to a report that private payroll job growth was the lowest in 15 months. Then, Friday’s jobs report confirmed the dismal news, showing that only 126,000 new jobs were created in March, barely half of the consensus prediction of 243,000 new jobs. Most markets were mostly closed for the Good Friday/Easter weekend, but when markets re-opened Monday, the dismal jobs picture caused gold to surge on Monday, surpassing $1220. In general, gold tends to rise in reaction to negative economic statistics, since they cause traders to assume that the Fed won’t raise interest rates any time soon, thereby giving gold an even playing field. Gold Still Compares Favorably with Stocks and InflationSo far this year, silver is up 8% and gold is up nearly 2% vs. a flat stock market: The Dow is down 0.3%. Long-term, gold has done very well vs. stocks in most time periods, and gold has beaten inflation in ALL time periods over the last century. We have made this point often here, but the mainstream press often tries to put stocks in a good light (vs. gold) by picking their dates of comparison very selectively. For instance, some major news organizations, such as USA Today, The Wall Street Journal and Barron's have used 1980, a peak year for gold, as the starting point for their comparisons of gold and stocks. If they had picked a more neutral starting point, say 10 years ago, gold would have been the clear winner in a comparison with the stock market. For example, USA Today honored the 10th anniversary of the launch of the first U.S. gold exchange-traded funds (ETF) on November 18, 2004, but the text of their article used 1980 as a performance benchmark. If they had used the ETF’s launch date (when gold was $442 and the Dow was 10,572), they could have shown that gold had risen 190% vs. only 65% for the Dow. This award-winning Metals Report began weekly publication almost 10 years ago, in August of 2005. Since then, we have compared weekly gold to stock prices since 2000 and 2005. In August of 2005, we didn’t know that gold would explode in price from around $450 at the time to $1900 in 2011 and then settle back to $1220 today, but our weekly table of stocks vs. gold has shown that gold has clearly beaten both the Dow Jones and the S&P 500 stock indexes since 2000 or 2005 and even the crisis year of 2008.If you measure metals vs. stocks for the first 15 years of the 21st century, gold is up 321%, while the Dow Jones Industrial index has gained just 55% and the broader S&P 500 index has risen by only 41%.Here is the record for gold, the Dow and the CPI over the last century. Bear in mind that comparing the long-term value of the price of gold with the Dow Jones Industrial Average is misleading, confusing and perhaps even deceptive. An ounce of gold is always an ounce of gold, but the components of the Dow index have changed more than 50 times since its inception in 1896. There have been over a dozen stock changes just since 1999, removing low-performance stocks and replacing them with more popular stocks.

Gold vs. the Dow and Inflation Since 1914

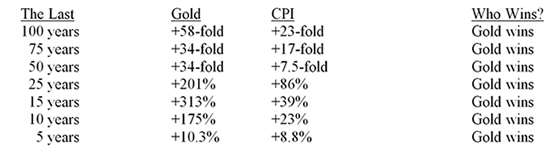

From this table, you can see that gold has beaten inflation in every time period over the last century.

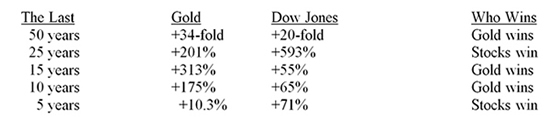

The comparison between gold and the stock market is not so clear-cut, since the Dow Jones index is the only comprehensive index that goes back a full century. As mentioned earlier, the Dow has changed its contents dramatically from decade to decade. General Electric (GE) is the only stock that has remained in the index since 1914. We would be comparing apples to oranges by using the 1914 Dow, so we’ll limit the comparison to the last 50 years, when gold compares favorably with the Dow over most time spans:

Gold vs. the Dow Jones Index

In conclusion, any fair time comparison shows that gold beats inflation over any long-term time horizon in the last 100 years or more. As for stocks, gold and stocks are both good long-term investments, so it pays to hold meaningful positions in both stocks and gold. The next time your see anyone use a negative chart about gold’s performance, remember that “if you control the end points” of any chart you construct, then “you control where the trend points.” Any fair analysis of gold’s performance over the long term shows that it beats any paper currency ever printed, and it often beats the stock market, too. Old Indian Book and New Type III Double Eagle Book Desired by Dealers

|