Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

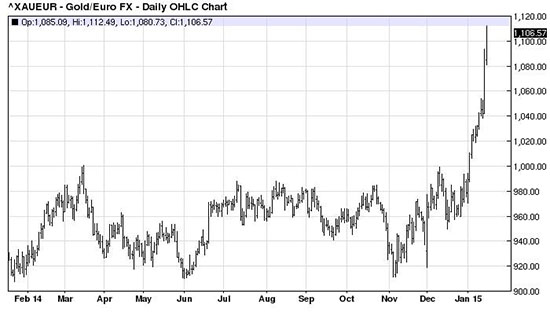

January 2015, Week 3 EditionGold shot up to $1280 last Friday, after the Swiss National Bank removed its “peg” to the euro (established at a ceiling of 1.20 Swiss francs per euro in 2011), sending the Swiss franc up 15% to the euro and pushing gold immediately above 1100 euros per ounce, up from under 1000 euros a week ago. The Swiss acted in advance of the European Central Bank (ECB) meeting this Thursday, which will probably result in further “quantitative easing” (QE) measures, including negative interest rates, so the Swiss acted pre-emptively to take their relatively valuable currency off of its peg to the declining euro. Type III Double Eagles RevisitedMy new book on Type III Double Eagles, to be released by April 2015, should increase demand for coins in this series. In 2000 my first edition about this popular series received the Numismatic Literary Guild Investment Book of the Year Award further boosting interest in double eagles. There will be some gorgeous photographs and innovative tools in this new edition that should greatly help collectors, investors and dealers who participate in this popular series. Gold Explodes (in Euro Terms) in a “Hockey Stick” Chart PatternAll during 2014, the euro price of gold seemed to have a ceiling at 1000 euro. Gold began 2014 at 837 euros per ounce and almost reached 1000 euros twice, but with the recent dollar surge, the powerful Swiss franc move, and the probable exit of Greece from the Eurozone in a popular vote scheduled for January 25, the whole Eurozone is losing faith in their home currency. From February through December 2014, the price of gold in euro terms remained fairly flat, between 900 and 1000 euros, but in the first half of January 2015, gold in euro terms shot up above 1100 euros, in a classic “hockey stock” chart pattern:

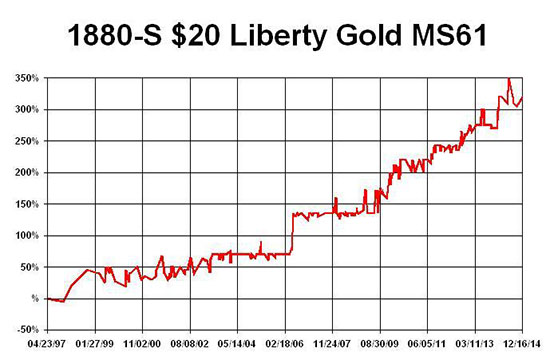

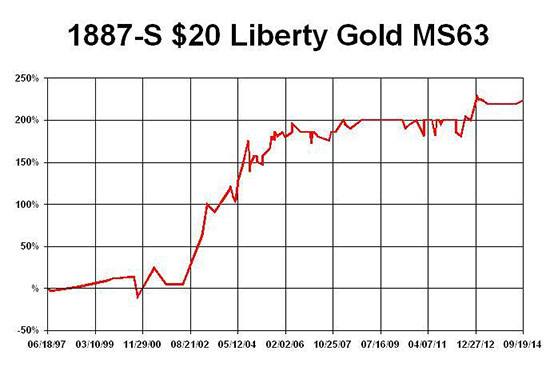

So far in 2015, gold is up over 13% in euro terms and up 7% in U.S. dollar terms, while the U.S. stock market is down, giving 2015 a good start toward a positive year for gold vs. a struggling stock market. Rare Gold Coin Performance ChartsFor decades, I have liked better-date rare gold coins. I even wrote multiple NLG award-winning books about them. Currently I believe it is a historically opportune time to acquire select better-date gold coins in better grades. The percentage movements shown in the charts below are based on the prices I paid for these coins on the dates indicated. Some coins are trending upward and others seem to be at bargain levels to many experts. Segments of this market now remind me of the old oil filter commercial that said “You can pay me now or pay me a lot more later.”

|