Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

October 2014, Week 1 Edition

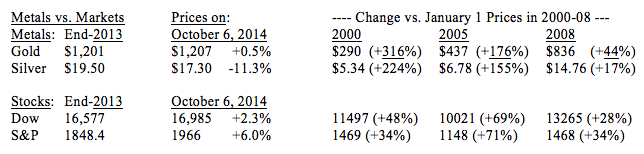

Gold fell to an annual low of $1193 last Friday, based on a positive jobs report and a strong U.S. dollar. This decline raised fears that gold could set new four-year lows. The London low last year was $1192, set on June 28, 2013. The lowest London price fix this year came on the October 6 morning setting at $1193.25. Later that day, gold rose back above $1200, so gold may have “passed the test” by bouncing off last year’s low. (The last time gold closed below $1190 was over four years ago, on July 30, 2010.) Federal Marshals Chase Famed Treasure HunterTommy Thompson was the toast of treasure hunters and the coin world in October 1988 when he discovered the stunning lost treasure of the SS Central America, a ship that went down in a storm off the South Carolina coast in 1857 with millions of dollars in gold on board. Now Thompson is a man on the lam with U.S. Marshals on his tail. Thompson’s elation at finding the rich treasure was short-lived as challengers came out of the woodwork to claim a piece of the pie. Long and arduous legal battles followed. In 1996, Thomson’s company was awarded 92% ownership of the treasure find, with the rest divided among some of the insurers of the ship. His legal troubles weren’t over, though, as investors in his company and even members of his crew claimed they hadn’t been paid shares that were promised them. So he disappeared. It’s not clear exactly when he dropped out of sight. What is known is that on August 13, 2012, he failed to appear at a hearing in the court battles, and a federal judge found him in contempt and issued an arrest warrant. In a court deposition, maintenance worker James Kennedy said that not long after that he went inside the Florida mansion where Thompson lived and found pre-paid disposable cellphones and bank wraps for $10,000 bills, along with a book called How to Live Your Life Invisible. Gil Kirk, a former director of one of Thompson's companies who says he put $1.8 million of his money into the treasure hunt and has not been repaid but still supports Thompson, commented that Thompson’s dream became his doom. “Tommy used the word, what's the word?” Kirk said. “Plague of the gold.” Meanwhile, salvage operations continue off the coast of South Carolina at wreck site of the SS Central America. Remotely operated vehicle dives, using more modern equipment, have recovered more gold and silver coins. The recovery and sale of more Type I $20 Liberty gold coins from this shipwreck should boost interest in all types of $20 Liberties in the near future. My new book on Type III Double Eagles, to be released in early 2015, should also increase demand for coins in this series. In 2000, my first edition about this popular series received the Numismatic Literary Guild Investment Book of the Year Award further boosting interest in double eagles. Physical Gold Demand Is Rising In Australia, Asia And Here At HomeIndia has been slow to reverse its onerous gold restrictions, but gold’s latest price decline has made gold more affordable there, especially after the government has allowed more trading houses to import gold. India’s demand should continue to increase, since the government announced cuts in gold and silver import taxes last week. The gold import duty will be cut 5.7% and silver’s duty will be 11% lower. Even before those lower duties took effect, gold imports increased an astonishing 13,595% in September 2014 vs. the same month a year ago. From a microscopic 0.153 tons in September 2013, gold imports reached 20.8 tons, a 16-month high, in September 2014. Indian demand could be primed for explosive growth. Australia’s Perth Mint also recorded rising physical gold sales in September, fueled by lower prices. The Perth Mint sold 68,781 ounces of gold coins and bars in September, the highest level since October 2013. August sales were only 36,369 ounces, so September’s totals represent an 89% month-over-month rise. Singapore said that it will start trading kilogram bar gold contracts next week. The contract for 25 kilograms of .9999 gold will be launched next Monday, October 13. This comes on top of the new Shanghai gold contracts, launched on September 18, reflecting rising gold demand in Asia. Meanwhile, the U.S. Mint followed suit, with 58,000 ounces of American Eagle coins sold in September, up 132% from 25,000 ounces in August and up 346% from the 13,000 ounces sold in September of 2013. Taco Bell Promotes Morgan Silver DollarsThe text of the latest Taco Bell TV ad is a perfect educational tool for rare coin investors. The ad shows a grandfather proudly telling his grandson that “this silver dollar has been in our family for generations.” He tells the wide-eyed boy that “I had it with me the night I won the heart of your grandmother” (that would have been around the 1950s, when silver was still common in U.S. coinage). He goes on to say the dollar has a small bullet hole in it, claiming that it saved his life during a “construction riot” in the 1960s. The grandfather is about to make the historic transfer of family wealth from one generation to the next when he sees a Taco Bell sign advertising their $1 menu items, so he interrupts himself in mid-sentence: “And now I want you to have … [sees the $1 menu sign] … oh, never mind.” The ad concludes that “no dollar is safe.” A more accurate lesson, of course, would be “Gresham’s Law” (named for Henry VIII’s finance minister), which says “bad money drives out good.” In this case, grandpa would spend his paper dollars for tacos and save the silver dollar, but Taco Bell pays for the ad, so grandpa wastes his heirloom. A Morgan silver dollar is worth roughly $15 for its melt value alone, and far more for its condition and rarity, so grandpa could treat over a dozen Taco Bell customers to a $1 meal by using his silver dollar!

|