Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

September 2014, Week 1 EditionGold fell to $1265 on its Tuesday opening after the Labor Day weekend break. Most of the decline is due to a strong dollar, which has served as a relative "haven of safety" from weaker currencies in Europe and Asia in response to the conflicts in Russia and the Middle East. The dollar hit a 13-month high this week. The euro started 2014 strongly, at $1.40 to the dollar. At the start of 2014, gold was $1201 per ounce, so an ounce of gold cost 858 euros on January 1. This week, the euro is $1.31 and gold is around $1268, so the euro price is 968 euros per ounce, so gold is up 12.8% in euro terms vs. just 5.6% in U.S. dollar terms. Despite a Slow Start, September is Historically Gold's Best MonthDespite the slow start this week, September has historically been gold's best month, for a variety of very logical reasons. This is the beginning of a series of global holidays in which gold-giving is considered a traditional sign of love, or at least good luck. Over the last 20 years, according to Bloomberg, September averages a 3% gain in the price of gold. No other month averages 2% or more. November is #2 at 1.8%. India's Diwali festival falls in late October this year, so Indian jewelers will be importing and fabricating gold into jewelry in advance of that holiday and the Indian wedding season. Then comes Christmas in the West, followed by the Chinese Year and Valentine's Day, making September to February the key six-month gold-giving season - what U.S. Global mutual fund manager Frank Holmes calls "the love trade.” India's punitive gold import regulations are limiting demand in that massive nation, but gold smuggling is increasing alarmingly. Last quarter, the Indian government seized $44 million in gold at major national airports. The number of seizures at the Mumbai airport grew over 500% in the second quarter of 2014 vs. the same quarter in 2013, and it's safe to say that the government can't catch more than a few smugglers. Another boost for gold demand this month will be the opening of the Shanghai Gold Market (SGM) at the end of September. China wants to compete with London and New York as a major global center for gold. They are planning to offer three gold contracts in Shanghai - 100 grams, 1000 grams and 12.5 kilogram bars - all to be quoted in terms of the Chinese yuan rather than the U.S. dollar. Most news reports tend to label gold demand in China and India as being sub-par this year, but the flip side of that coin is that most Asian gold markets tend to be price-sensitive, so Asian gold demand could rise after the recent correction. Experts Say that Gold is Waiting for an "Inflation Trigger”One of the sharpest gold minds in the world is Ross Norman, CEO of Sharps Pixley, a leading London bullion dealer. He expects a total gain for 2014 in the single-digits (i.e., a closing gold price of $1320 or less by the end of 2014). He cites the threat of deflation now haunting Europe. He believes that gold will only rise when inflation inevitably returns. He expects to see this "inflation trigger" for higher gold prices to strike some time in 2015 or 2016. Some of the things that could push that time table forward would be another geopolitical crisis or global financial crisis in the stock market's weak months (September and October), as in 2008, which could send gold prices up sharply. Although "core" inflation (ignoring food and energy) is hovering around the Federal Reserve's target rate of 2% per year, the wholesale cost of food has been skyrocketing lately. Here are a few of the leading wholesale food contracts traded on the U.S. commodity exchanges, four of which are up by double digits. Wholesale Food Price Increases

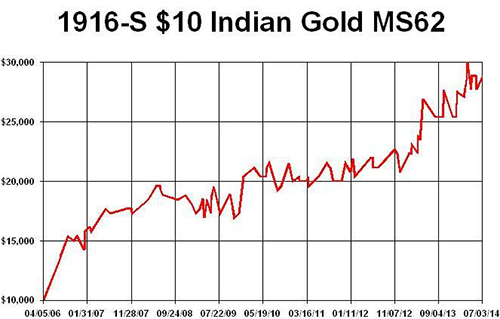

(2014, year-to-date, based on Commodity Exchange data) While average Americans see inflation at their local grocery store and at gas station, central bankers tend to ignore food and energy prices. They follow other prices (such as electronics or housing), which tend to decline in price or remain fairly stable. The Federal Reserve has more than quintupled its balance sheet from $800 billion to over $4 trillion in the last six years, and all those dollars have to go somewhere! Rare Gold Coin Performance ChartsFor decades, I have liked better-date rare gold coins. I even wrote multiple NLG award-winning books about them. Currently I believe it is a historically opportune time to acquire select better-date gold coins in better grades. This week's graphs show how a portfolio of multiple or fractions of coins totaling $10,000 in different rare gold coins would have increased in value over the time indicated that I have purchased them. These graphs reflect the price gains of actual coins I have been fortunate to buy, showing an increase from $10,000 to as much as $53,000. Some series are trending upward and others seem to be at bargain levels to many experts. Segments of this market now remind me of the old oil filter commercial that said "You can pay me now or pay me a lot more later.” I recommend at least a 5-10 year hold period on rare coin purchases as these graphs show impressive gains and volatility can occur during a shorter time span. We all know that past performance of some coins does not guarantee future performance for all coins. Many experts recommend buying better-dates and grades because of often better long-term performance for much of the past 100 years. Read my books to learn about famous successful long-term gold coin set builders like Louis Eliasberg. His set building provided him long-term benefits of diversification and significant premiums were later realized.

|