Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

July 2014, Week 5 Edition

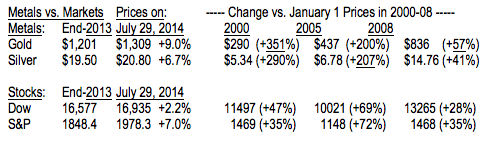

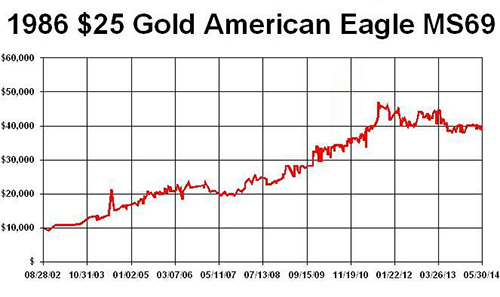

Gold is still trading above $1300 per ounce, which tells us that buyers keep coming out of the wings and into the market whenever they see a perceived "bargain" when gold dips into the $1290s range. The U.S. economic news picked up last week - including the lowest number (in over 8 years) of new applications for jobless benefits - so Fed Chairwoman Janet Yellen said the Fed could raise interest rates sooner than expected. This gave the dollar a boost, pushing gold temporarily down, but gold rallied by week's end. SO MANY WARS BREAKING OUT, WHY ISN'T GOLD SOARING?The weekend Wall Street Journal covered gold with a negative headline: "Even in Rockets' Glare, Gold Dims." The author, Liam Denning, opens up by saying "Paranoia, war, economic dystopia: The world of the gold bug isn't a very happy place." That's a terrible misconception. We have been saying all along that gold is now more of a "prosperity hedge" than a crisis hedge. When the world prospers, billions of more people can afford gold jewelry for their loved ones, or gold investments for their secure future. We do not need war to help our gold investments grow, even though war can give gold a temporary boost. So far this year, gold has surged during the most severe outbreaks of tension in the Russian/Ukraine conflict, but it's important to realize that there hasn't been that much shooting (so far) in this war. The sides are basically posturing politically and threatening violence, but in terms of historic comparisons, the world is relatively at peace. Researchers have determined that the last decade has been the most peaceful in over 100 years. If you want to see a time when gold soared due to global tensions, look to the outbreak of World War I a century ago, when all major stock markets in Europe and America closed. There was a run on U.S. banks as depositors demanded gold for their cash, resulting in multiple U.S. bank closures. (From July 27 to August 7, 1914, $73 million in gold was withdrawn from New York banks alone.) The world may seem more violent and dangerous than ever, but that may be due to the instantaneous transmission of violent incidents from millions of amateur news reporters - all carrying their cell-phone cameras, which record and transmit video violence almost instantaneously. The world is always a dangerous place, but we are reminded of that fact more insistently now, in the age of online social media. The flip side of this statement is that when a real shooting war finally happens in Ukraine or Israel or Iraq, we will see the results almost immediately, and this will probably fuel another surge in the gold market. Short-term surges in gold are caused by leveraged trading, primarily on the COMEX in New York, but long-term gains are generated from "buy and hold" investors from around the world, primarily in China, India and the Middle East. The best barometer for gold's long-term rise is rising middle-class prosperity in those lands which revere gold - namely, China, India, the Middle East and most of Asia. The World Gold Council estimates that China's middle class will grow by 200 million (to 500 million) in six years. They also project China's private sector gold demand to grow 25% by 2017 due to their rising incomes, but all you hear in the Western press these days is about a slowdown in Chinese gold demand recently. IS CHINA'S GOLD DEMAND REALLY SLOWING DOWN?Last Friday, the Wall Street Journal ran a gold article ("Dip in Chinese Demand Puts Pressure on Gold" by Tatyana Shumsky) which covered the China Gold Association's latest report, which said that gold demand in China fell 19.4% for the first six months of 2014 vs. the first half of 2013. Their report also said that China's domestic gold production rose by almost 10%, resulting in a supply/demand overhang. Last year at this time, there was a huge demand in gold due to its price decline in the second quarter. In the first half of 2013, China's gold demand reached 706.4 tonnes vs. 569.5 tonnes in the first half of 2014. Despite these seemingly dismal statistics, the people at Casey Research looked more closely into the Chinese gold market and came up with a major flaw in these reported statistics on Chinese demand. Basically, the China Gold Association measures gold imports coming to China through Hong Kong, while ignoring the gold the Chinese government imports directly into Beijing, which are not reported in any official gold import statistics. We usually don't know until long after the fact that China has added gold to its foreign exchange reserves, but the trend is clear from past pronouncements. We now know that China held 500 tonnes of central bank reserves in 2001, doubling to 1,054 tonnes as of April 2009. We don't know how much gold Beijing holds now, but the best estimate is about 4,500 tonnes of gold, but even if that figure is on the high side, that leaves more room for China to catch up with the other major powers. The euro-zone holds over 10,000 tonnes of central bank gold, while America holds over 8,000 tonnes. China is a competitive nation. They will try to reach that 10,000 tonne threshold someday. P.S. Two other gold-friendly nations are increasing their demand for gold and silver, respectively: Russia's central bank bought 500,000 more ounces of gold in May. In the latest three months on record (March, April and May), Russia added 1.7 million ounces - a 6.8 million ounce (211.5 tonne) annual rate. India has not relaxed its gold import restrictions as expected, but that has only increased the amount of silver imports into the country. The World Silver Survey 2014 reports that India's silver bar demand hit 80.7 million ounces last year, the highest ever recorded and eight times the demand in 2012. If India drags its feet on reducing gold taxes and tariffs, silver should set another record for demand in 2014, too. RARE GOLD COIN PERFORMANCE CHARTSFor decades, I have liked better-date rare gold coins. I even wrote multiple NLG award-winning books about them. Currently I believe it is a historically opportune time to acquire select better-date gold coins in better grades. This week's graphs show how a portfolio of multiple or fractions of coins totaling $10,000 in different rare gold coins would have increased in value over the time indicated that I have purchased them. These graphs reflect the price gains of actual coins I have been fortunate to buy, showing an increase from $10,000 to as much as $40,000. Some series are trending upward and others seem to be at bargain levels to many experts. Segments of this market now remind me of the old oil filter commercial that said "You can pay me now or pay me a lot more later.” I recommend at least a 5-10 year hold period on rare coin purchases as these graphs show impressive gains and volatility can occur during a shorter time span. We all know that past performance of some coins does not guarantee future performance for all coins. Many experts recommend buying better-dates and grades because of often better long-term performance for much of the past 100 years. Read my books to learn about famous successful long-term gold coin set builders like Louis Eliasberg. His set building provided him long-term benefits of diversification and significant premiums were later realized.

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |