Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

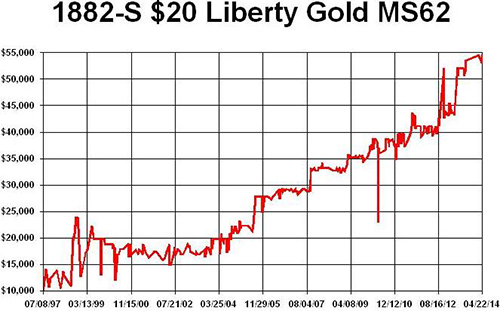

July 2014, Week 3 EditionGold rallied strongly last week - while stocks declined - due in most part to the escalation of violence in the Middle East. Hundreds of missiles were launched into Israel and the ISIS militants gained ground in Iraq. As a result, gold kept rising last week, based on its role as a global crisis hedge. But on Monday, July 14, gold suffered its worst one-day collapse of the year, falling $30 back to $1308 on some negative fundamentals for gold supply and demand, namely (1) India is not reducing its gold tariffs from the currently stiff 10%, (2) Chinese demand has trended down recently, and (3) mining companies have resumed their forward-selling of gold output, which tends to put a damper on any gold price increase. Rare Gold Coin Performance ChartsFor decades, I have liked better-date rare gold coins. I even wrote multiple NLG award-winning books about them. Currently I believe it is a historically opportune time to acquire select better-date gold coins in better grades. This week’s graphs show how a portfolio of multiple or fractions of coins totaling $10,000 in different rare gold coins would have increased in value over the time indicated that I have purchased them. These graphs reflect the price gains of actual coins I have been fortunate to buy, showing an increase from $10,000 to as much as $65,000. Some series are trending upward and others seem to be at bargain levels to many experts. Segments of this market now remind me of the old oil filter commercial that said “You can pay me now or pay me a lot more later.” I recommend at least a 5-10 year hold period on rare coin purchases as these graphs show impressive gains and volatility can occur during a shorter time span. We all know that past performance of some coins does not guarantee future performance for all coins. Many experts recommend buying better-dates and grades because of often better long-term performance for much of the past 100 years. Read my books to learn about famous successful long-term gold coin set builders like Louis Eliasberg. His set building provided him long-term benefits of diversification and significant premiums were later realized. Fickle Wall Street Traders Rush In (And Out) Of GoldAccording to the U.S. Commodity Futures Trading Commission, the net long position in gold futures rose 20% in the week ending July 1, the highest weekly gain since March. The trend continued last week, when the CFTC data showed that large speculators continued to raise their net-long precious metals holdings in the week ending July 8. In the first half of 2014, net long positions rose four-fold (+300%). Last week, gold ETF holdings also grew at their fastest rate since 2012 - when gold prices were much higher - as some gold bears came out of hibernation and bought gold. Alas, some of these same fickle traders pushed the panic button early this week and sold their gold positions, pushing the metal down. Sometimes, collectors and investors in rare coins have to just forget about the daily mood swings on Wall Street and acquire top-quality independently-graded U.S. coins for their long-term investment potential… In bullion coin sales, Australia’s Perth Mint sold 39,405 gold ounces last month, a four-month high. June American Eagle gold coin demand was 48,500 ounces, 37% above May and the best month since January. Barron’s Interviews Veteran Gold Fund ManagerJohn Hathaway, 73, has been involved with gold investments for several decades. He is co-manager of the $1.6 billion Tocqueville Gold Fund, which he helped launch in 1998, when gold was still struggling to stay above $300 per ounce. In this week’s Barron’s, Hathaway expanded on gold’s current fundamentals: “The gold price has discounted all of the headlines that were responsible for driving it lower, including the continuation of tapering [of the Federal Reserve’s asset purchases] by the Federal Open Market Committee. After the FOMC’s latest meeting in June, the price of gold actually went up. That was a departure from the previous 11 meetings, after which gold declined when tapering was discussed.” In his latest letter, Hathaway listed problems in the financial markets, including “a bear market in stocks, a rise in inflation, or geopolitical issues. All three factor in to the way people look at gold. For any market, you can’t really say what is the flash point is. But there is a fair amount of complacency among equity investors - a feeling that we can party on until we all know when to get it.” “The central thesis and rationale for owning physical gold is that the radical monetary policies put into place since 2008 to rescue the financial system will become problematic. What’s more, Federal Reserve officials seem to be so comfortable saying that unwinding of quantitative easing will go smoothly. But maybe, from the point of view of someone who is thinking about investing in gold, that unwinding won’t go smoothly, and will lead to disruptions in the financial markets. We have abnormally low interest rates because that’s where central banks want them. The Fed achieved that goal by buying up Treasury issues.” On the supply side, Hathaway said: “Because of cutbacks and a more conservative approach to capital expenditures by managements of most mining companies, it looks to us like new mine supply will level off and maybe even decline after next year. You’ll still have gold being mined, but the supply isn’t going to rise, possibly for three or four years starting in 2016. The second level, which is even more important to the gold price, is the above-ground supply of gold. This is more of an apocryphal number, but it is supposedly around 170,000 tons,” meaning that global supply only “grows by maybe 1% to 2% a year.” “A lot of the physical gold that’s above ground has migrated to Asia. Imports into China have been at record levels and India is a big buyer of gold, as well. There is less gold in Western vaults than there was a couple of years ago. But because Asian investors tend to hold their gold - they don’t view it so much as a trading vehicle - it may not be available, should there be a rise in investment demand in the West. “If, for whatever reason, people who hold financial assets want to go into gold, the supply of it doesn’t expand rapidly.In fact, it might not expand at all during a period of high financial-market demand, and that’s why you get these extreme moves in the price. If we’re at a stage where, for whatever reasons, Western demand for gold awakes from a 2-1/2-year nap, there is probably going to be less of it to go around, and we could get dynamic moves on the upside. Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |