Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

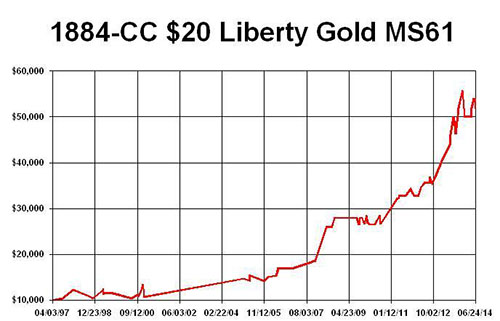

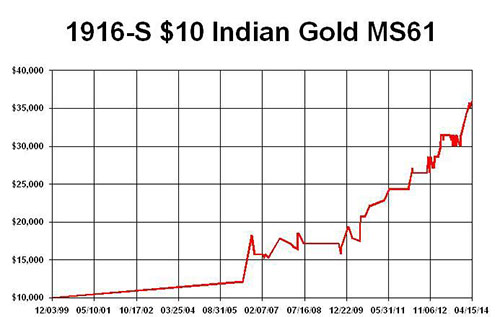

July 2014, Week 2 EditionGold corrected below $1310 on Thursday, July 3, due to a relatively strong jobs report, but gold bounced back above $1320 by the close of the day, going into the Fourth of July weekend. Thursday's headlines made the job picture look rosy, but the 288,000 net job gain in June amounted to a net loss of 523,000 full-time jobs and an addition of about 800,000 part-time jobs, hardly a healthy situation, so the stock market declined on Monday. Through July 3, gold is now up 10% vs. just 3% for the Dow Jones stocks. Rare Gold Coin Performance ChartsFor decades, I have liked better-date rare gold coins. I even wrote multiple NLG award-winning books about them. Currently I believe it is a historically opportune time to acquire select better-date gold coins in better grades. This week's graphs show how a portfolio of multiple or fractions of coins totaling $10,000 in different rare gold coins would have increased in value over the time indicated that I have purchased them. These graphs reflect the price gains of actual coins I have been fortunate to buy, showing an increase from $10,000 to as much as $70,000. Some series are trending upward and others seem to be at bargain levels to many experts. Segments of this market now remind me of the old oil filter commercial that said ”You can pay me now or pay me a lot more later.” I recommend at least a 5-10 year hold period on rare coin purchases as these graphs show impressive gains and volatility can occur during a shorter time span. We all know that past performance of some coins does not guarantee future performance for all coins. Many experts recommend buying better-dates and grades because of often better long-term performance for much of the past 100 years. Read my books to learn about famous successful long-term gold coin set builders like Louis Eliasberg. His set building provided him long-term benefits of diversification and significant premiums were later realized.     New Demand Trends: Coins, ETFs, China and IndiaGold moved from a low of $1240 in early June to $1335 on July 1, so June was a good month for gold: Gold coin sales are improving in several global mints. The Perth (Australia) mint says that sales of gold coins and their minted bars have "climbed to the highest level in four months in June as a rally in prices spurred demand." In the U.S., the American Eagle gold coin also enjoyed a great June, with 48,500 gold Eagle ounces sold, up 37% from the May totals of only 35,500 ounces of Gold American Eagle coins. Gold ETFs (exchange-traded funds) also enjoyed a good month. Holdings in the SPDR Gold Trust, the largest gold ETF, rose to 796.4 metric tons as of July 1. Barron's reported a 20% increase in speculative gold positions in the futures and options markets for the week ending July 1. Two consecutive days (June 30 and July 1) marked the biggest two-day gain in SPDR gold holdings since last November. (The ETF sell-off last year was a major cause of gold's decline in 2013.) Looking back at the first half of 2014, Barron's said: "ETF flows in the first half of 2014 suggest that the bulk of the selling is now behind us.” China is still the #1 nation for gold production and consumption. The China Gold Association predicts that domestic Chinese gold demand will reach 1,176 tonnes in 2014, almost half of all newly-mined gold. India is gradually repealing their onerous gold import tariffs, with some dramatic results: In India's northern state of Gujarat, imports reached the highest level in 13 months. Gold imports in June reached 14.33 tonnes, the first time that monthly gold imports surpassed 10 tons since India's tariffs were passed early last year. Bank of America Merrill Lynch is now predicting that "Net gold imports will increase to $40 billion or 2% of GDP in Fiscal Year 2015, from $28.8 billion or 1.5% this past fiscal year.” The Federal Reserve's FOMC Minutes will Emerge This WednesdayThe key to gold's continued growth in U.S. dollar terms is the continued easy-money environment at the Federal Reserve. Gold's recent dip to $1310 on Monday reflects the assumption that quantitative easing (QE) will end this year and the Fed may raise short-term interest rates early next year. However, the Fed is still "easing" (creating liquidity) and they are not liable to raise rates more than a few basis points (one one-hundredth of one percent), from maybe 0.25% up to 0.50% by this time next year - i.e., not much! Fed Chairperson Janet Yellen has already downplayed rising U.S. inflation statistics as "noise." The Fed is ignoring a dramatic rise in prices of food and energy - two essentials in most American households - since they are not part of the "core" inflation formula the Fed monitors. This Wednesday, we will learn more about what the Fed feels about inflation, interest rates and the economy when they release their minutes of the last Fed Open Market Committee (FOMC) meeting in mid-June, but the likelihood is that Yellen (the "Queen of the Doves") will err on the side of more easing, not tightening, of the U.S. dollar. Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |